Under the influence of the fourth industrial revolution, fierce competition in Vietnam’s distribution and retail channels is changing quickly, creating four major trends in the market, said an expert.

In Vietnam, the distribution network and domestic retail sector make up 15% of the GDP and create jobs for nearly 6 million people, said economist Vu Minh Phu at a conference discussing the potential of Vietnam’s distribution network on October 3.

With a population of nearly 100 million, the country’s final consumption expenditure has been maintaining at a high rate of over 70% annually, indicating huge potential remains for the market, Phu added.

Others factors that contribute to the attractiveness of Vietnam’s distribution network and retail market include young people accounting for 50% of the population, the nearly-untapped market in rural areas, and modern trade channels holding 25% of the market share.

Total goods retail sales and service revenue expanded at a double digit rate in recent years, but “the online retail market only accounts for 5% of total revenue,” Phu stressed.

Phu pointed to four major trends of Vietnam’s distribution and retail channels:

Firstly, the trend of forming joint ventures and mergers and acquisitions has been flourishing in the retail field in the last four or five years, which help create large scale retail corporations with high competitiveness in the market.

Some of notable M&A deals are Central Group's acquisition of the Big C super market chain for US$1.05 billion in 2016; Vingroup acquiring Fivimart and Shop & Go; Saigon Co.op taking over French retailer Auchan’s Vietnam operation, among others.

“They are strong enough to compete with big rivals and have an advantage in terms of input and output goods and the quality of products,” Phu said.

These major retail corporations in Vietnam are expected to have major influence on the country’s market, while the competition would become fiercer. Under this circumstance, small retailers with limited corporate governance, professionalism and inefficient business models are subject to M&A, bankruptcy or losing their brands on the market.

The trend will continue its upward spiral in the coming months, Phu noted.

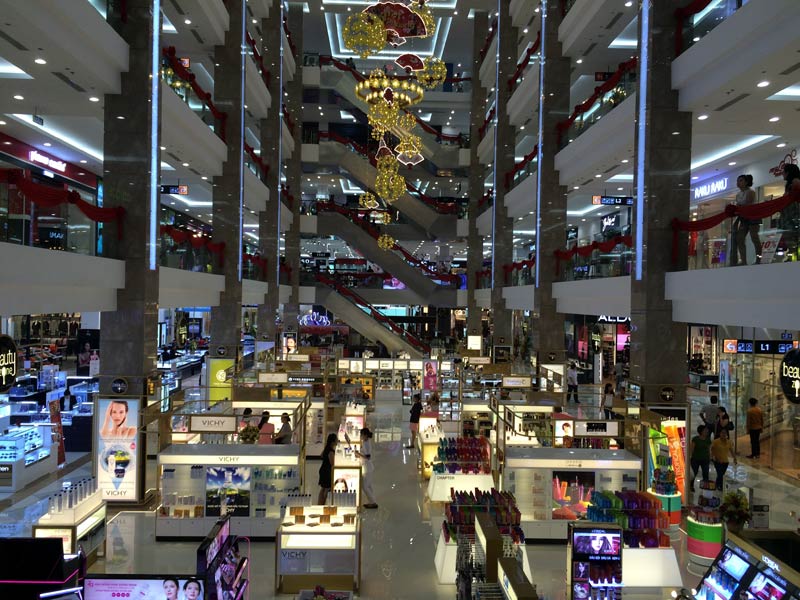

Secondly, trend and demand of creating diversified shopping experiences for customers. In recent years, some major retailers have built large scale shopping malls and entertainment centers (Vincom Mega Mall, Aeon Mall) that provide enjoyable experiences for customers in shopping, thanks to the application of digital technologies and supporting apps for shopping installed on customers’ mobile phones.

On the contrary, single super markets, malls and commercial centers that serve a few certain customer segments and fail to learn the importance of customer shopping experience are subject to closure. Parkson and Auchan are some notable names in this case.

Thirdly, as a founder of the first supermarket in Vietnam and an observer of the retail sector for a decade, Phu stated that the trend of building facilities specialized in purchasing agricultural products and food from many areas and regions is on the rise. Farm produce, which is varied in Vietnam and widely grown, is being eyed by retailers.

Major retailers are focusing on setting up their own purchasing center as part of the distribution network. Through these centers, retailers are able to control products quality, ensuring the uniform standards applying to harvesting and storing processes, leading to competitive products prices and a foundation for later export.

Metro Cash & Carry was the first retailer following that trend, and now Thailand’s Central Group, Aeon, Vingroup, Saigon Co.op also set up their respective purchasing and quality control centers in provinces and cities having advantages on agricultural productions.

Fourthly, the introduction of omni channels and Multichannel sales platforms were also presented as a trend of the retail sector by the economic expert. The fact that 70% of Vietnamese population have smart devices, coupled with the rapid advancement of digital technologies, artificial intelligence, big data, among others, are generalizing online shopping and opening up new sales playground among customers and retailers.

However, e-commerce activities in Vietnam are facing several legal bottlenecks in terms of regulations during the development process, of which the main issue is the lack of measures to control quality of product sold online, reducing shoppers’ confidence in these items. As such, setting up multiple sales platforms is considered a good way to diversify retailers’ services and gain further ground in the retail market.

As a result, there have been retailers providing services both online and through brick – and- mortar stores. For example, retailers could advertise their products online but deliver the products and receive payment right at their stores.

Omni channels are considered an inevitable trend for Vietnam’s retail market, however, there remain issues in state governance of this promising distribution channel in Vietnam.