Hanoi Retail

Hanoi Retail Market started 2019 with the launch of one new retail project, Sun Plaza Ancora, adding 16,100 sq.m NLA to the market. By the end of 2019, retail supply will grow by 21% compared to previous year, bringing total space to surpass one million sq.m. Midtown and the West will continue to dominate market supply as 126,700 sq.m will be added in 2019 in this area. On the other hand, residential developments and infrastructure improvements will lead to more retail supply in the South with two openings in 2019 – Hinode City and Sun Plaza Ancora.

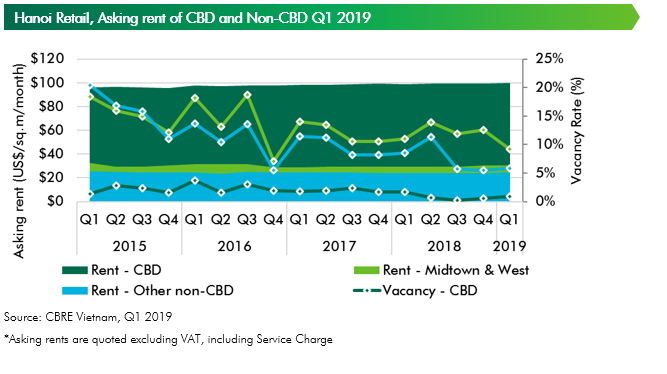

Slight pick up of ground floor rents was recorded in CBD the first quarter of 2019, reaching US$100/sq.m/month, up 1.1% y-o-y and 0.5% q-o-q. As no new supply in CBD is expected in 2019, average asking rents in this area will continue to post positive growth in the coming year while vacancy will continue to stay at level as low as 1%.

Ground floor rents in the largest retail supply area, Midtown and the West remained stable at US$30.4/sq.m/month in Q1 2019 as the market gradually absorbed new opennings in 2018. Vacancy in Midtown and the West decreased to 9.3% in Q1 2019, down 1.8 ppts y-o-y and 3.3% q-o-q. However, this area is most likely to see rent adjustment and increased pressure on vacancy by the end of 2019 with four future projects (nearly 70% of new supply) located in this area. Retail centers in Other non-CBD location saw rents up by 1.7% y-o-y to US$24.5 while vacancy up by 2 ppts y-o-y to 5.9% by end of Q1 2019 with the opening of Sun Plaza Ancora in January 2019.

Supermarket and convenience store in Hanoi continued to see the dorminance of one local player, Vingroup. The local conglomerate acquired Fivimart chain in 2018 and most recently acquired 87 stores of a convenience store chain, Shop&Go.

Amid the disruption of e-commerce, while F&B is gaining market share with impressive growth in Internet retailing, other retailers face the challenges of keeping track with changing consumers’ behaviors and shopping habits. In March 2019, online fashion arm of Central Group, Robins.vn, was announced suspended, following the closure of online website vuivui.com operated by Mobile World in December 2018.

HCMC Retail Market

HCMC’s total retail supply increased by 67,200 sq. m NLA in the first quarter of 2019 from a new shopping center, Gigamall (by Khang Gia Land) in Thu Duc District. Although being located in non-CBD, Gigamall achieved an occupancy rate of more than 90% at its opening with more than more than 40% of total NLA designated for F&B. Gigamall’s anchor tenants include Sense City (33,000 sq. m), CGV Cinema (3,200 sq. m), JP World (1,500 sq. m), California Fitness & Yoga (3,000 sq. m), etc. Sense City Pham Van Dong, located on levels 1-2-3 of Gigamall, is the first Sense City (by Saigon Co.op) in HCMC.

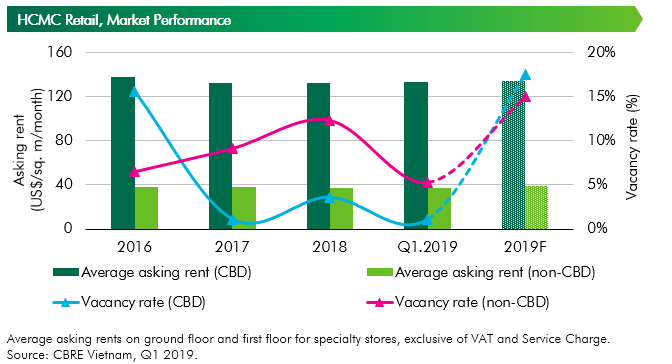

Average asking rents in CBD increased by 0.4% y-o-y, equivalant to US$128.6/sq. m/month, thanks to improving demand for CBD space given limited supply. Meanwhile, non-CBD average asking rent increased by 1.0% y-o-y, reaching US$35.7/sq. m/month, thanks to good absorption at new projects such as Gigamall and Estella Place.

Vacancy rate in CBD hit a 5-year low at approximately 2%, thanks to limited supply. The vacancy rate in non-CBD was also low at 7.3%, down 2.3 percentage points y-o-y.

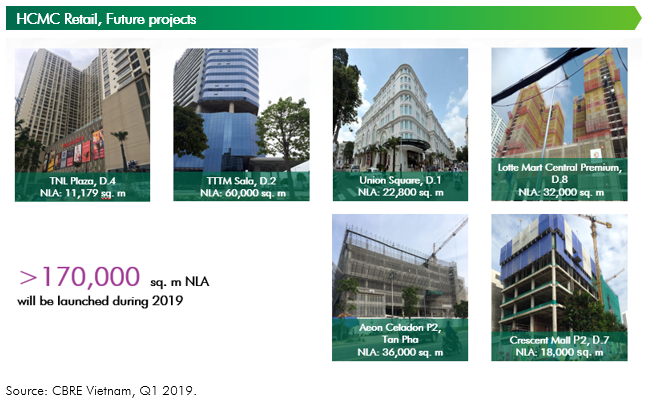

However, similar to the HCMC office market, the HCMC retail market awaits a large future supply in 2019. The cumulative supply in 2019 is forecast to increase by 25% compared to 2018, with new supply mostly in the east of the city. Six new projects in the pipeline are under construction with a total NLA of 179,979 sq. m. Union Square is the only project to come online in 2019 that is located in the CBD, while the remaining projects are all in non-CBD. In District 2, Sala Shopping Center, with an NLA of 60,000 sq. m, once opened in 2019 will be the first shopping center in Thu Thiem area.

Over the next three years, the HCMC retail market will become more competitive, especially in non-CBD, as many large-scale condominium projects will be completed and a significant supply of retail podiums is expected to be added accordingly.

In 2019, increasing new supply in both CBD and non-CBD is expected to raise vacancy rates in these areas, to 17.5% and 15.3%, respectively. Despite scarce supply in CBD, occupancy rate of the new supply in 2019 (to open after renovation) will not be extreme given its large scale and high rental rate, leading to higher vacancy rates in CBD.

In 2019, new supply in prime locations of both CBD and non-CBD, typically offering higher asking rents, are expected to push average rents in these areas to US$134/sq. m/month (+1.5% y-o-y) and US$39/sq. m/month (+5.4% y-o-y), respectively.

In the near future, along with the rise of consumer confidence, changes in consumer behaviours and technology advancements, the retail market in HCMC will continue to grow in a positive direction:

- In 2019, an increasing number of international brands will enter the HCMC market, such as well-known F&B retailers from Asia-Pacific nations like Hai Di Lao Hot Pot and Hachiban Ramen, or specialist clothing brands from Europe like Olivia Burtons. Since CBD supply is scarce, prospective tenants have little advantage in opting for locations while landlords have the opportunity to select their tenants.

- As HCMC has been chosen by many foreign and local brands looking to open their first store in Vietnam, pop-up shop format, which is a low-risk starting point to test a new and potential clientele, is gaining more popularity. These stores typically have unique and interesting designs that trigger curiosity in customers, luring them to visit the store.

- Online retailers are expected to be more active in 2019 as they continue to develop and invest in e-commerce and logistics platforms. According to a report by Euromonitor, internet retailing grew by 32% in 2018, reaching total sales of US$1.65 billion. Looking forwards online retail turnover is expected to increase by more than 20% per annum over the next three years. In recent years, some retailers, especially electronics & appliance, have adopted omni-channel strategy, allowing consumers to look for product specifications and compare prices online before purchasing.