A corner of CoGo coworking space in Hai Ba Trung District, Hanoi.

Supply growth to accelerate

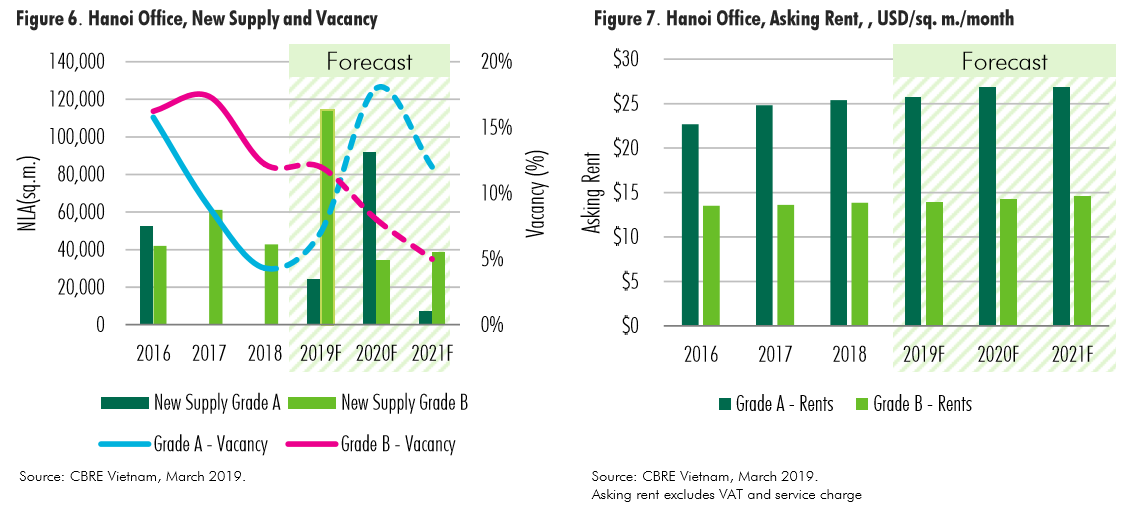

A significant amount of office space is expected to complete in 2019 adding 138,000 sq.m, NLA to existing supply. Accordingly, Hanoi office stock will increase by 11% y-o-y reaching 1.3 million sq.m NLA. The supply growth rate of 11% exceeds previous levels of 4% per annum on average during 2016 – 2018.

Grade B completions continues to be the major source of new supply with eight buildings in the West and Midtown submarkets covering 82% of total new supply in 2019.

For Grade A segment, after three years of no new supply, the market will welcome one new building – Thaiholdings Tower (NLA: ~24,500 sq.m). The new project will provide opportunities for occupiers who want to expand in the CBD – a submarket where stock has been unchanged during the last five years.

Looking beyond 2019, Hanoi office expects to welcome even more sizeable buildings, some of which by foreign developers.

Rental growth to moderate while net absorption to remain healthy

In 2019, although there will be higher volume of new supply potentially posing pressure on leasing activity, we still expect healthy net absorption across both segments. As seen in 2018, stronger pre-commitment as well as improved leasing speed at new projects led to the absorption reaching 100,000 sq.m, NLA –the highest level observed over the past three years. In 2019, the combination of healthy demand from both traditional sectors and co-working providers as well as quality new office supply will support the performance of office market in Hanoi. We expect net absorption rate to stay at a similar level to the previous year. As such, vacancy of Grade B is expected to remain unchanged at 12% while that of Grade A to increase by 4 ppts y-o-y reaching 7% respectively this year. From 2020, further supply growth is expected to create further pressure on vacancy rates.

Although there will be stronger new supply volume in 2019, rental rates are expected to grow at a moderate pace of around 1% level for both grades in 2019. For Grade A, rental growth is expected to be slower than the levels experienced in 2017 and 2018. On the back of limited new supply, rental growth recorded a 10-year high in 2017, achieving more than 9%, then slowed to more than 2% in 2018. With the amount of new supply anticipated in 2019 and beyond, rental growth for Grade A is to further slow to around 1% on average for the year. Grade B’s rents are also expected to grow at a similar pace of 1%, which is relatively stable comparing to the past two years. New buildings at good locations with better specifications will be asking higher rents catering to the expansion demand of international tenants with high leasing budget. Meanwhile, landlords at low-vacancy buildings seem to have increasing negotiation power at lease renewals.

While relocation and expansion are still the main drivers for office leasing demand, renewals will continue to be popular among tenants in buildings in the CBD.

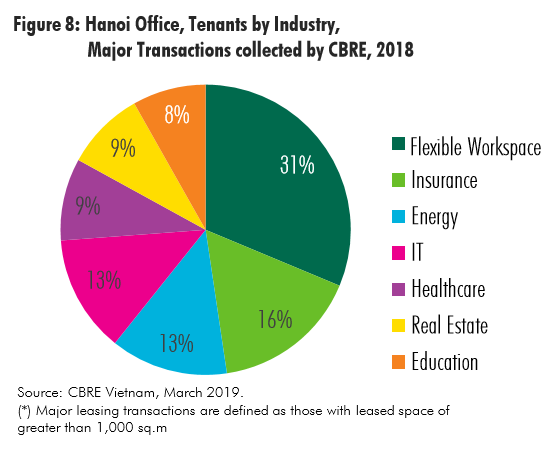

Flexible space providers are expanding quickly to become big occupiers and major source of leasing demand

Continued healthy office demand is expected in Hanoi in 2019. On the back of strong economic fundamentals, the Financial and IT/Tech sectors remain in good shapes and stable demand drivers. The tenants from these sectors continuously accounted for around 40% of CBRE’s leasing enquiries over the past three years. Among companies in the financial sectors, local banks and international insurance companies are expected to be the most active players looking for new office space. These companies are either seeking new locations for both back office and branches for the purpose of expanding their networks and scales. Meanwhile, IT/Tech sector witnessed expansion of both local and international firms in 2018; CBRE expect the same trend to persist in 2019.

In 2018, flexible space in Hanoi grew at 77% and accounted for the largest proportion (31%) of major leasing transactions in Hanoi recorded by CBRE, showing greater presence of this sector in leasing demand. The growth of this model has been driven by the needs of improving space efficiency of corporate clients. Flexible space providers have actively approached these occupiers to introduce build-tosuit service as a cost saving and workplace solutions. Meanwhile, the cooperation of flexible space providers and landlords to add co-working component in traditional office buildings have also supported the expansion of this model.

As such, CBRE forecasts that the flexible space providers will continue to be a major source of leasing demand in 2019.

In terms of sizing, the most common enquiries to CBRE have been office space of under 500 sq.m, covering around 45% of CBRE’s enquires in Hanoi in 2018. In upcoming years, we expect there will be stronger demand for larger office space of more than 700 sm. The share of this sizing is expected to increase from current level of 20% to 30% to CBRE’s leasing enquiries in 2019.

From 2019 onwards, tenants will have more options to consider given increasing volume of office supply to be introduced from both Grade A and B. Locations such as Midtown and West submarkets will continue to appear in the prioritized option lists of IT firms and Insurance/Bank branches. Meanwhile, MNCs, Embassies and Financial sectors will have new options in the CBD for their expansion or relocation plans.

Outlook

Solid expansion of Finance and IT/Tech sectors and persistently strong growth of Flexible space will drive the Hanoi office market in 2019.

Supply to grow at a higher rate than previous years to meet growing demand.

Grade A’s rents in existing projects to be stabilized while newly completed projects will ask for higher rates. For Grade B segment, rents only expect to increase slightly as landlords look to ensure occupancy.