Strong surge in the number of newly registered enterprises

In Jan-Sep period, nearly 102,300 enterprises were newly established, according to market research firm JLL. The average registered capital reached VND 12.6 billion per enterprise, up 26.6% y-o-y. In the same period, there were 6,000 newly registered businesses in real estate sector, up 20.7% over the same period last year and accounting for 5.8% of the total newly registered one. In addition, there are 21,200 enterprises stopped operation and pending for dissolution procedures. Among them, 11,900 enterprises had their business registration certificates revoked under the 2018 data standardisation programme which aimed to eliminate businesses established but no longer in operation. In 3Q19 alone, there were 35,300 newly established enterprises, down 8.2% yo-y in the number of companies and 11.2% y-o-y in registered capital.

Ho Chi Minh City office rents continue to move upward

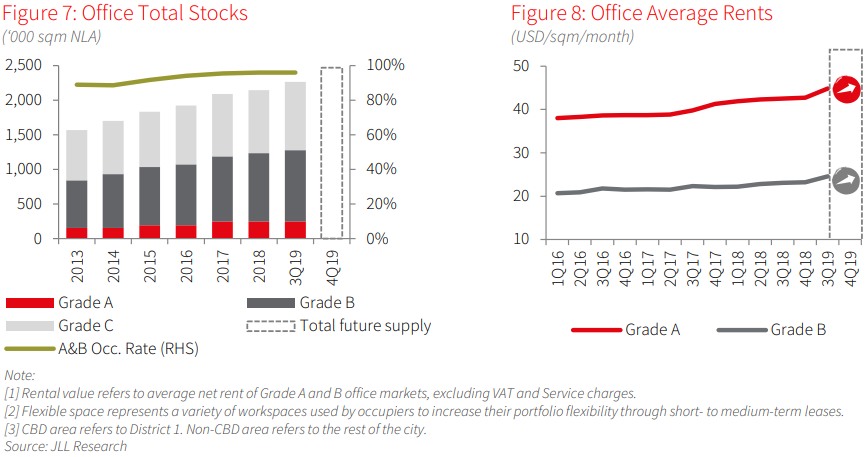

Grade A&B saw occupancy rise further to 96%. This was up by 51 bps y-o-y and 19 bps q-o-q in spite of new supply entering the market. Pre-commitment in future supply in CBD was positive owing to healthy demand on the market. In line with office demand, demand in flexible space was good, mainly coming from corporate tenants.

In 3Q19, the HCMC office market welcomed 24,000 sqm of one new Grade B building in Tan Binh and 11,200 sqm from three new Grade C buildings in Phu Nhuan and District 3. As a result, the total HCMC office stock stood at 2,266,800 sqm (including Grade A, B and C) as at end of 3Q19. Despite the new supply, available space continued to be limited with the Grade A&B average occupancy rate recorded 96% as at end of 3Q19. The restricted leasing options in CBD area still remained. This situation is expected to be eased down by end of 2019 with the completions of two new buildings, namely Lim Tower 3 and Sonatus Tower.

Grade A&B rent kept moving on an upward trend and increased to USD28.8 per sqm per month, up 5.9% y-o-y and 0.8% q-o-q. Grade A average rent rose to USD44.8 per sqm per month, up 5.3% y-o-y and 1.0% q-o-q, while its Grade B counterpart grew faster at 7.0% y-o-y and 1.1% q-o-q. This was owing to the existing high level in Grade A rents has left limited room for further growth.

In 4Q19, the market is expected to welcome seven new buildings coming on stream, adding a total of 115,000 sqm of all grades office space . Subsequently, total HCMC office stock will increase to 2.38 million sqm by end-2019.

Demand is forecasted to stay positive in near future, however, global economic uncertainty may effect unpredictably on office market. Besides, the enriched new supply coming on stream in the next three years may put some pressure on existing supply’s performance.

Under impact of global climate change, green and sustainable office concepts are making way to becoming an inevitable trend of future completions.

Hanoi office market welcomes new supply in Grade B

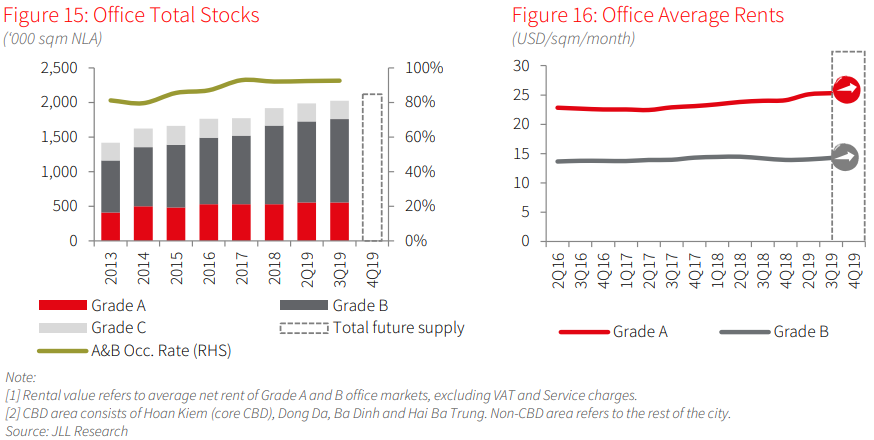

The occupancy rate of Hanoi office market was kept relatively stable and reached 92.5%, an increase of 20 bps q-o-q, despite new buildings entering the market. During the quarter, Grade B market continued to be active, as the net absorption was recorded at approximately 37,000 sqm. Grade A witnessed a minor negative net absorption, mainly due to an anchor tenant relocating to their newly-built office. However, the majority of Grade A offices still performed well in 3Q19. For example, ThaiHolding Tower, the newest Grade A building, despite its selective leasing strategy, continued to secure more tenants.

No new Grade A supply was recorded this quarter. Meanwhile, Grade B sub-market continued to welcome more projects in 3Q19, which helped to increase the total supply of Hanoi Grade A&B office by approximately 2%. Of the 3 newly-launched buildings, Doji Tower had the highest asking price, thanks to its prime location in the intersection of Ba Dinh and Hoan Kiem districts. The other two buildings were located in the west side of Hanoi, a trend that had been witnessed in recent years when new office clusters were formed in Cau Giay and Tu Liem area.

In 3Q19, the average rent of Hanoi Grade A&B office continued to inch up 0.3% q-o-q and 4.0% yo-y, underpinned by healthy demand. In Grade B sub-market, average rent has been trending upwards since the beginning of 2019 and posted a stronger rental growth of 2% q-o-q, as compared to 0.8% q-o-q recorded in Grade A in 3Q19. This was attributable to more availability with good quality and reasonable prices in the submarket. On the other hand, rent in Grade A sub-market grew at slower pace than 2Q19, as tenants had more alternatives from Grade B offices, giving them better negotiation power.

In 4Q19, while no new supply is expected in Grade A sub-market, Grade B is likely to see some coming on stream. Although the market is currently favouring the landlords, the market sentiment could be turned around with more supply forecasted to launch in 2020 coupled with uncertainty in the global economic outlook. The complexity should be paid close attention by all stakeholders of the market.