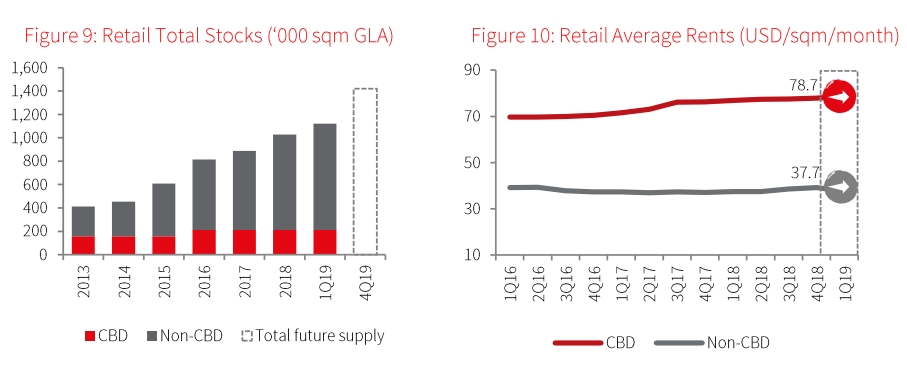

According to data from JLL Vietnam, as of the end of the first quarter of 2019, total retail stock in HCMC reached 1.2 million sqm. Supply increased strongly by 7 percent QoQ and 14 percent YoY, while capacity was stable at 96 percent. The vacancy rate was 12.3 percent because of the remarkable new supply entering the market.

High competitive pressure from new supply has caused many retail centers in non-CBD areas to cut down rents. This move has led to a slight decrease in the average rent of the whole HCMC retail market.

Demand remained positive

Retailers in fashion, accessories and F&B categories were the most active in the quarter, showing a particular preference for quality space. Besides, car manufacturers, technology stores, education institutions and healthcare stores with the plan to expand the footprint will emerge to drive the demand.

In general, demand for HCMC retail market remained healthy with overall occupancy registered at 88%, slightly lower q-o-q owing to the new completion in the review quarter.

New retail space from large-scale projects in non-CBD

In 1Q19, Gigamall was officially put into operation in Pham Van Dong, Thu Duc District, adding a significant amount of 92,800 sqm to the total stock. The mall is now the largest shopping centre in HCMC Given its large scale, Gigamall became operational with 60% occupancy, of that Sense City hypermarket, the anchor tenant of the mall, occupied a large proportion of space.

Ho Chi Minh City retail market performance. (Source: JLL)

Rents decreased, driven by lower rent level in non-CBD

Lower-than-average rent in the new large scale completion in non-CBD has strongly impacted the market-wide rent. As a result, average overall market rent in 1Q19 experienced a temporary decline to around USD $45.4 per sqm per month, decreased by 4.0% q-o-q and 2.0% y-o-y. HCMC retail in is starting to reach the middle of the growth slowing stage, where rents are stable but slowing down, before entering the declining period, according to the rental cycle.

Regarding location, chain-link change in CBD rents slightly improved while that in non-CBD contracted by 0.4% q-o-q, a result of large supply influx in this area.

Outlook

2019 is expected to witness a sizeable amount of new supply coming on stream, approximately 300,000 sqm GFA locating in non-CBD area, of that Aeon Mall Than Phu – P.II is the most notable project, contributing 83,000 sqm.

Tenants who require large space such as flexible space, clinic, education, entertainment, and so forth continue to fill up vacant space in upper floors of retail centres which usually attract less foot traffic versus the lower floors. More international retailers are expected to enter the city, bringing more demand for high-quality space, especially in CBD.

Clothing giant Uniqlo is about to stir up Vietnam retail scene.

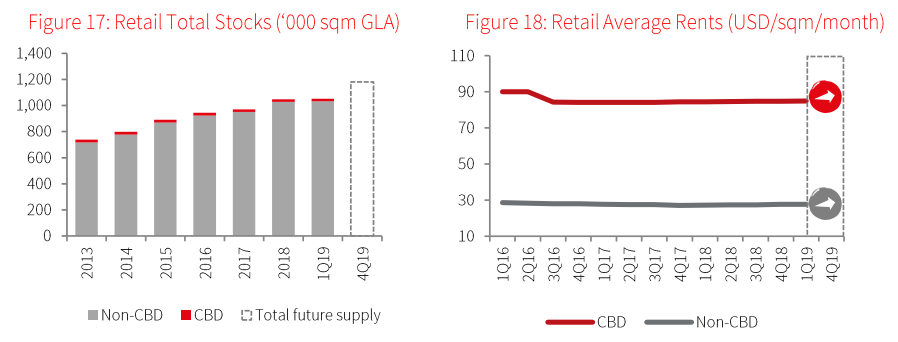

According to JLL’s first quarter market report, There was no new retail project completed in Hanoi, keeping total stock unchanged at nearly 1,053,000 sqm, up by 8.4% y-o-y. The demand for projects having good catchment area and eye-catching visibility remained strong. However, the Hanoi retail market is heading towards the very end of the rents rising stage and about to reach the slower period of growth in the rental cycle.

Leasing environment stable

In 1Q19, the occupancy rate reached nearly 90%, up by 1.6% q-o-q, a result of notable net absorption of 20,610 sqm recorded in the quarter. Vincom Metropolis Lieu Giai was fully occupied with high-quality tenants after three months of operating, thanks to its good project design and prime location.

Good quality F&B and fashion operators drive most leasing enquiries in the 1Q19.

No new openings in 1Q19

The total convenience stores continued to show expansion with more stores opened by branded retailers such as Circle K and Vinmart. As of 1Q19, the total existing space reached 80,100 sqm, mainly came from non-CBD sub-market.

Rents grew moderately

The overall market rent was at around USD $28.8 per sqm per month, increased by 2.0% q-o-q and 1.1% y-o-y. In CBD area, the average rent was recorded at USD $84.9 per sqm per month, up by 0.2% q-o-q, while non-CBD area saw a moderate increase 0.3% q-o-q, at USD $27.7 per sqm per month.

Outlook

Approximately 126,900 sqm is expected to come on stream by the end of 2019, with nearly 46% of the total from Cau Giay District. All new retail projects are located in non-CBD area, putting pressure on developers to fill up vacant spaces.

Although rents are expected to only rise gradually, rising consumer incomes should help support fundamentals and in turn investor interest. The disruption from the e-commerce market is also another factor forcing landlords of brick-and-motar malls to quickly adopt new and unique concepts to bring customers back to malls.

Hanoi retail market statistics. (Source: JLL)

Positive outlook signs are shown in both Hanoi and HCMC markets and this is owing to two factors: stable growing economy and improving retail turnover.

The country’s economy took place in the context of slowing global economic growth with increasing challenges and risks. As of 1Q19, the GDP’s growth reached 6.79%, lower than the 1Q18 rate yet still higher than the growth of the first quarter during 2011-17 period. This is due to several factors such as electronic manufacturing weekened and abnormal movements of the livestock industry driven by African swine fever virus. It is expected that under the management of the Government, this year’s growth target at 6.6%-6.8% is still atainable.

As of 1Q19, the total retail sales of consumer goods and services achieved a considerable growth of 12%, compared with last year. Moreover, Vietnam’s personal consumption expenditure is growing by over 6% annually. Realizing this opportunity, international clothing giant Uniqlo will soon start to open stores in Vietnam.