New launch supply in Ho Chi Minh condominium market would improve in the second half of the year.

Hanoi Condominium

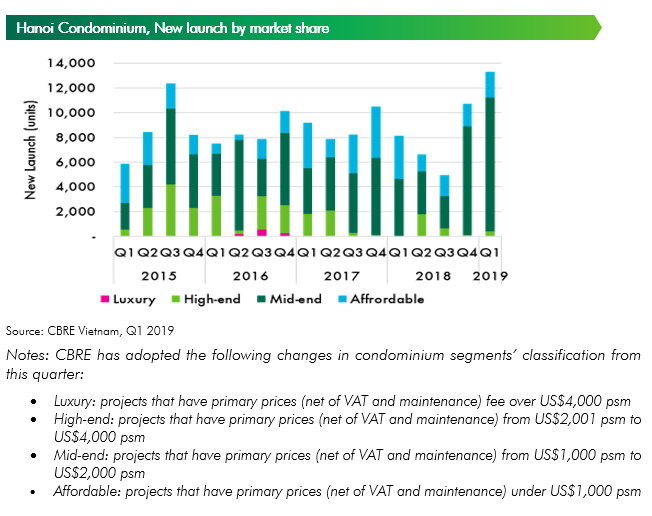

In Q1 2019, the Hanoi condominium market recorded one of the highest number of units launched in a quarter. A total of 11,822 units were launched from 26 projects, up by 46% as compared to Q1 2018. Notably, most of the units launched were from follow-on launches of mega projects such as Vinhomes Ocean Park (Gia Lam District) and Vinhomes Sportia (Nam Tu Liem District). In terms of location, the East leads the new launch supply covering 57% of total new launch in Q1 2019.

Despite Tet break, sales transactions remained strong during the quarter. An estimated 9,390 units were sold during the quarter, 36% higher than that of Q1 2018. Active sales and promotions activities by developers before and after Tet holiday supported sales performance during quarter. Mid-end segment maintained its highest share of total units sold making up 68% of total transactions recorded this quarter. The market has witnessed strong demand from both local and foreign investors for projects at locations close to industrial parks (East) or expat communities (West or Tay Ho district).

In terms of pricing, selling prices in the primary market in Q1 2019 averaged US$1,333 per sq.m., a slight increase of 1% y-o-y. The launch of luxury and high-end apartments at prime locations in the CBD and Tay Ho area in this quarter led to higher primary prices. Additionally, follow-on launches of certain projects also offered higher primary prices in comparison with previous towers.

Moving forward, the level of new supply is expected to stay at above 32,000 units in 2019 – a relatively similar volume as seen during 2016 – 2018. Mid-end segment continues to dominate the market with forecasted share to new supply of around 65 – 70% pointing out that Hanoi market is end-users-oriented. Sales performance, thus, is forecasted to reach 28,000 – 30,000 units in 2019. In terms of primary pricing, average pricing level in 2019 is predicted to be slightly higher than that of 2018 given high proportions of mid-end and affordable in total new launch supply.

HCMC Condominium Market

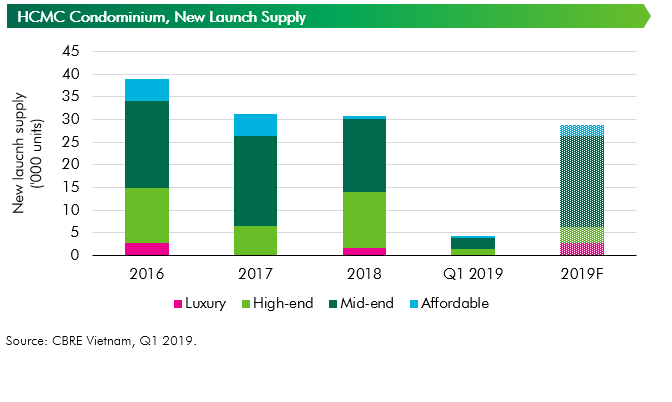

In line with CBRE’s forecast by the end of 2018, HCMC condominium market was quiet in the first three months of 2019, with new launch dropped significantly due to long Tet holiday and slow licensing process. The number of newly launched projects was lowest in the last three years, with only 12 projects, including both new project lauching first phase and old projects launching subsequent phases (normally from 18 to 20 projects launched per quarter, on average). Units from projects that launched the first phase accounted for 60% of total new launched units. Consequently, there were 4,423 launched units, decreasing by 46% q-o-q and 54% y-o-y.

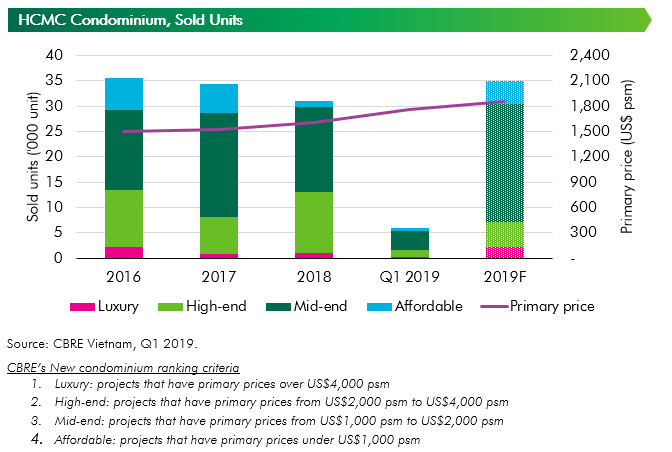

In the context of limited supply, good sold rates were recorded in all segments. Total number of sold units dropped purely because of the reduction in new launch supply. High sold rate from 90% to 100% was observed at projects from reputable developers with reasonable price. 5,924 units were sold in Q1, a decrease of 28% q-o-q and 39% y-o-y. Total number of sold units was 1,500 units higher than new launch, indicating that the market is absorbing inventories from previous launched projects.

In terms of market segmentation, mid-end segment accounted for 55% of total new supply in Q1 2019. This segmentation is expected to support a sustainable growth for HCMC condominium market by focusing on end-users. In terms of location, HCMC’s condominium market continued to expand towards the East and the South, with new projects in Districts 2, 8, 9 and Binh Chanh District.

The average primary selling price in Q1 2019 was US$1,764 psm, representing an increase of 3.1% q-o-q and 14.9% y-o-y. This price growth rate was partly due to the emergence of some luxury projects with high selling price. In general, new luxury projects launched in the last three quarters have set a new pricing level for the market with selling price from US$7,500 – 12,000 psm.

In 2019, new launch supply is expected to improve in the second half of the year. In total, new launch supply in 2019 is expected to reach 28,000 units. In terms of segment, mid-end and affordable will continue to dominate while new launch from luxury and high-end will only account for small proportion. The East will continue to be the market hot spot with new projects in District 2 and District 9. Inventory will be absorbed in next few quarters thanks to limited new launch supply.

Average selling price is expected to increase by 5% y-o-y. Selling prices in mid-end and affordable segments will have modest growth rate from 1%-3% y-o-y while high-end projects are expected to see selling prices higher 5% y-o-y. For approved luxury projects in District 1 and District 3, selling prices are expected to increase from 5%-7% y-o-y, due to scarcity of land bank in the city centre. Secondary market will be more active in 2019 thanks to shortage of new supply, especially in District 1, 2 and Thu Thiem area. Projects in these areas can achieve up to 15%-20% price growth compared with launched prices.