Grade B is the driver of the Hanoi apartment market in Q2/2019.

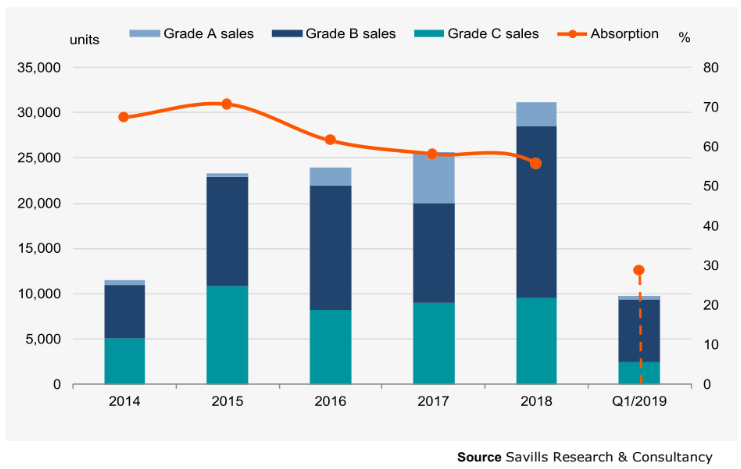

In Q1/2019, the total primary supply for sale were 34,400 units, a major jump of 43 per cent year-on-year, as reported by Savills. In terms of total sales volume, soft performance across all grades saw 9,800 transactions, decreasing -14 per cent quarter-on-quarter but increasing strongly 70 per cent year-on-year. Absorption rate in the first quarter of 2019 was modest at 29 per cent, down 3 percentage points quarter-on-quarter, but up 4 percentage points compared to the same period last year.

For three specific segments, Grade B was the market driver due to increasing end-user demand. Until 2020, more than 76,600 units will enter from 63 projects. Handovers proportion for Grade B was nearly two-third of the market, while launches accounted for 70 per cent overall.

Mr. Duong Duc Hien, Director of Residential Sales at Savills Vietnam, stated: “The shortage of commercial assets has left the residential sector the most realistic option for investors.”

Residential market performance.

Metrics temporarily declined

In the first quarter of 2019, there were 9,700 units added, falling off -36 per cent QoQ but rising 76% YoY. Due to business disruptions during Lunar New Year, launches decreased across all grades. Grade A dropped -84% QoQ whilst Grade B and C decreased -35% QoQ. There were approximately 9,800 sales, strongly increasing 70% YoY. In a QoQ comparison, sales decreased by -14% due to the long Tet holidays.

Mid-end Market Strengthens

Grade B remained the largest primary supplier at 22,500 units, representing 65% share. Ha Noi's apartment market is underwritten by strong occupier demand, whilst the high-end segment is appealing to small proportion of local high-net-worth individuals and international purchasers. Strong end-user and investor demand resulted in high Grade B sales, accounting for 70%, and the highest growth of 99% YoY amongst the three grades. Developers offered competitive prices, the average Grade B was approximately US$1,390/m2, down -2% QoQ but up 8% YoY.

Improved Apartment Affordability

Affordability in Viet Nam housing market has consistently improved over the last three years. The price-to-income ratio decreased from 34 in 2016 to 21 in 2018 due to Viet Nam’s booming HNWIs and middle class. Ha Noi’s price-to-income stood at 17, better than Vietnam’s overall position. Sales have increased since 2014, growing 28% pa.

Large Supply Wave

Approximately 44,000 units from 34 existing and future projects will enter. As Ha Noi’s five planned satellite towns are facing challenges with investment capital, population distribution and accommodation for workers, key players such as Vingroup and BRG are implementing large projects in Gia Lam and Dong Anh: VinCity Ocean Park (420 ha) and BRG Smart City (272 ha). These developments are a sustainable solution for easing population pressure, traffic congestion and infrastructure shortage.