In 2018, Vietnam proved it was one of the world’s fastest growing economies, recording its highest GDP growth for the last ten years at 7.1% year-on-year (YoY). Foreign Direct Investment remains the key to economic development, with over 50% of newly-registered capital coming from the processing and manufacturing sector, boosting industrial real estate, Savills reported.

In November, Mapletree Logistics Trust announced their acquisition of a Unilever warehouse in Vietnam-Singapore Industrial Park I for approximately US$31 million. The warehouse will be leased back to Unilever for ten years.

A month later in December, Amata Corporation, a Thailand-based industrial developer, commenced construction of Song Khoai Industrial Park, part of the mega project Amata City Ha Long in Quang Ninh province. This is a strategic step for Amata in expanding to the north of Vietnam, following Amata Bien Hoa Industrial Zone and Amata Long Thanh, both located in southern provinces. Covering an area of 5,789 hectares, the new project is planned as an integrated industrial city leading towards a smart city, with a total estimated investment capital of over US$1.6 billion.

Vietnam-Singapore Industrial Park I Binh Duong. (Photo: vsip.com.vn)

According to Savills quarterly report Q4/2018, residential players remained active in the fourth quarter of 2018. VinaCapital Opportunity Fund Limited (VOF) transferred 34.18% interest in Green Park Estate, a 15.7-ha mixed-use development project in Tan Phu District, Ho Chi Minh City. Another VinaCapital fund – Vinaland – holds 63.47% interest in the project but plans to divest in the near future.

Meanwhile, Vinhomes, the reputable local developer, announced plans for two new township projects: Vincity Ocean Park in Gia Lam District and Vincity Sportia in Nam Tu Liem District, Hanoi. These major projects will provide a comprehensive range of facilities and parks for health, education, entertainment, leisure and outdoor sports.

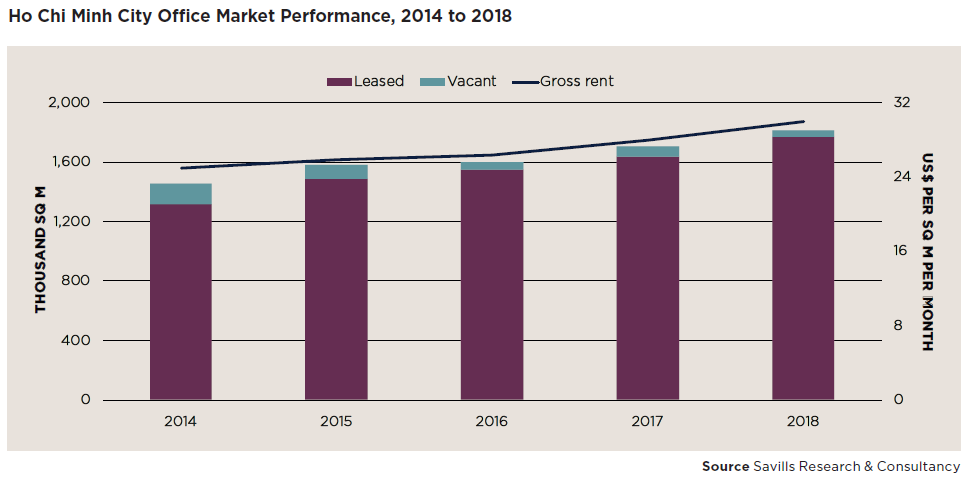

Office continued to be one of the most exciting property sectors across the region. Ho Chi Minh City enjoyed its best performance of the last five years, with average rents increasing 8% YoY and a very high occupancy rate of 97%, while Hanoi recorded a 3% YoY increase in average gross rent with improved Grade A performance in non-CBD areas.

Seeing great potential in the market, WeWork – a US-based co-working space provider – entered Vietnam with its first flagship site at E-Town Central in Ho Chi Minh City.

Promising potential of Vietnam office market. (Photo: ArchDaily)

Mr. Matthew Powell, Director Savills Hanoi said: “There is massive interest from foreign investors at moment. At the Savills Hanoi, Danang, and Ho Chi Minh offices, we seeing many investor groups each day, mostly new entrants, who are keen to explore opportunities. This interest is mainly coming from the region – Japan, Korea, China, Hong Kong, Singapore but also U.S., European, and global funds are investigating heavily. All the commercial and residential sectors are targets. Most of the investor interest comes from funds who are not looking to develop, so are looking to acquire operating cash-generating assets – office properties, retail malls, 4 and 5 –star hotels.

Looking into the future, we expect more deals in 2019 on asset, portfolio, and corporate investment level. The large number of IPO valuation projects on which Savills Vietnam is working demonstrates investors’ interest in the property market. With the promising prospect of many real estate sectors in Vietnam market, it is expected that investment flows will be directed to a wider variety of sectors, including opportunity assets like industrial and logistics properties.”

This movement of foreign enterprises is largely due to the affordability of Vietnam’s office market. "International companies are looking beyond the core office markets, such as Hong Kong, into emerging office markets of Asia Pacific for expansion or in some cases consolidation, which may help counter-balance the current high occupancy costs," says Jeremy Sheldon, Head of Markets, Asia Pacific, JLL.