Politics push South Korea and Vietnam closer but more importantly: At the right time

Major issues like U.S-China trade war and North Korea’s denuclearization have been around for a while, whereas South Korea – Vietnam have been in a close status long before, so why these political problems are coming at the right time?

Simple reason: Money! South Koreans are losing a lot of money and they urgently need to take actions.

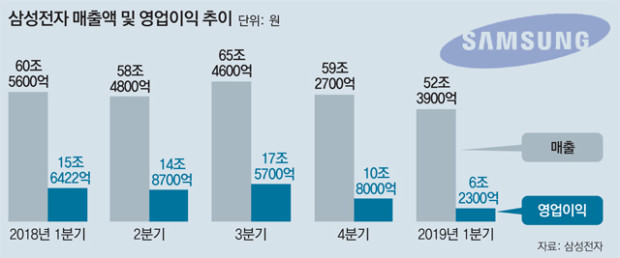

Samsung just posted a huge 60% profit drop, from 15.642 trillion won (US $13.382 billion dollar) in Q1 2018 down to 6.23 trillion won (US $5.33 billion dollar) in Q1 2019.

Samsung’s revenue and profit from Q1/2018 to Q1/2019.

A gloomy quarter for most Samsung’s units.

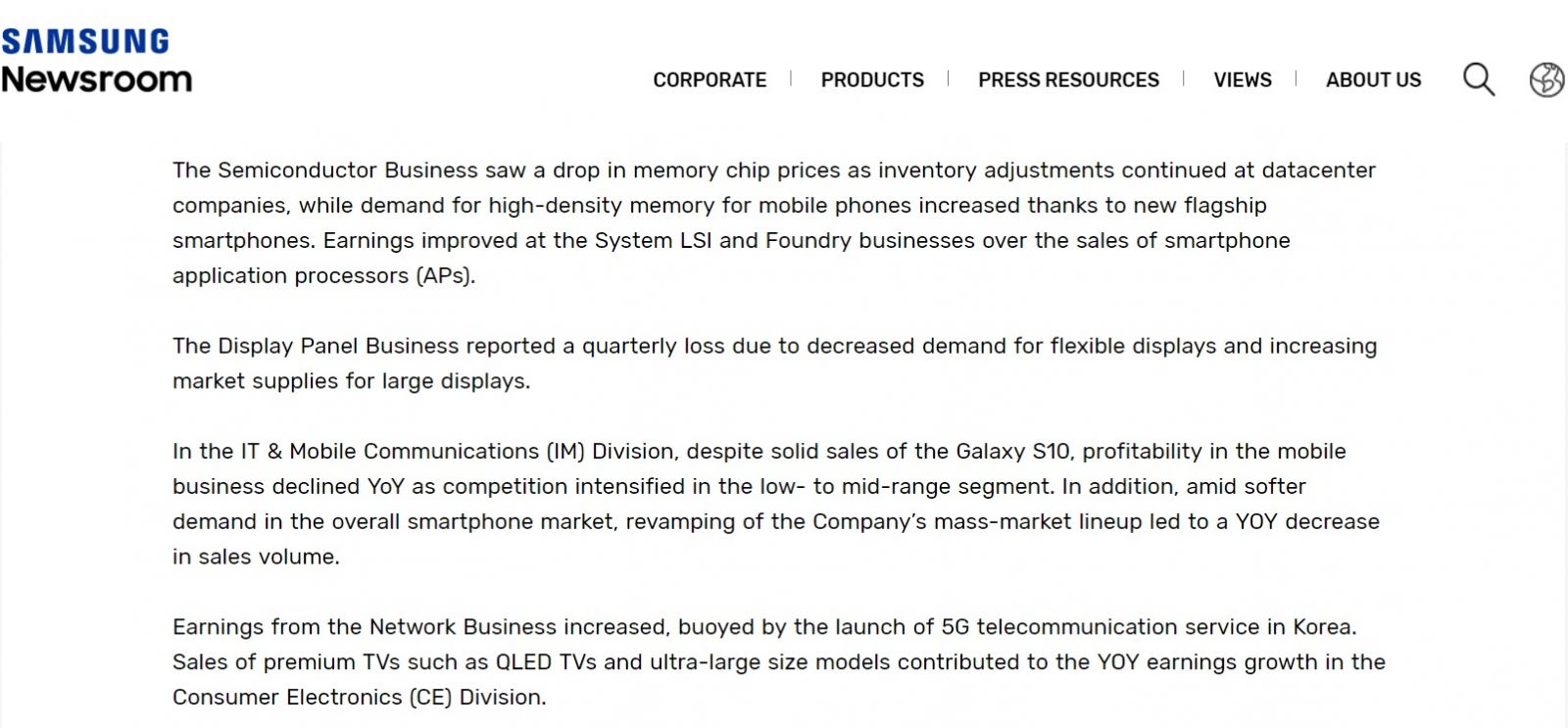

Another chaebol struggling with its mobile business is LG when it recently posted the fifth straight quarterly drop in sales.

5th quarterly sales drop of LG mobile.

Why did it happen to LG and even Samsung, the No. 1 smartphone maker? Because the saturated smartphone market is now a zero-sum game where one’s gain is another one’s loss and here, the winner is Chinese Huawei as it posted a 50.3% jump in market share (in shipment volumes).

Huawei made a whopping 50.3% YoY growth in shipment volumes.

Obviously, South Korean phone makers are losing massive market share to Huawei and we have yet even taken into account other Chinese players like Vivo, OPPO, and Xiaomi. The alarm for cutting costs to save business is ringing louder than ever, especially for LG and as a result, the chaebol has announced to move its mobile production from Pyeongtaek (Seoul) to Vietnam by year end.

So what does it mean for Vietnam?

Though LG Electronics (LG’s phone maker division) has operated Hai Phong factories for a while, its premium line of phones has been produced only in Pyeongtaek. Once the plant is moved, LG will have its full smartphones lineup in Hai Phong.

Thus, it will likely lead to consequent shifts of other divisions to Vietnam!

LG Display, supplier of OLED screens for LG phones, is an example. It makes great sense for the display business to ramp up its current production in Hai Phong to support upcoming LG’s full mobile lineup.

LG Innotek is another instance as it makes phone camera and sensing modules. Both LG Innotek and LG Display have factories in Hai Phong and post operating losses, leading to a stronger pressure for cutting costs and Vietnam is obviously a promising resolution.

Experts suggested that once US lifts its sanctions, North Korea will replace Vietnam as the No. 1 South Korean manufacturing hub, thanks to its similar language, close proximity, and cheap labor. Nonetheless, North Korea’s denuclearization is still delayed, together with the current U.S. sanctions as well as disunity between the North and the South, are major blocks for that notion.

Besides, Vietnam is not only a cost-cutting solution but also a profit mine proven by many contracts between Hyundai’s units and Vietnamese corporations. For example, Hyundai Aluminum supplied its Low-E heat-resistant glass for Landmark 81 (Ho Chi Minh) and Hinode City (Hanoi), while Hyundai Elevator just became a strategic supplier of Hoa Binh Construction, with an investment of roughly US $25 million dollar to hold stakes in the Vietnamese construction firm.

Hoa Binh and Hyundai Elevator signing ceremony.

Thus, besides global political storms, Vietnam’s manufacturing sector will continue to benefit from the chain reaction of South Korean chaebols’ divisions and affiliates, leading to certain advantages for industrial estates as well. Thanks to that unstoppable flow, the industrial segment is a good choice for conservative investors and they should definitely eye on industrial properties in cities like Hanoi, Bac Ninh, Hai Phong, Ho Chi Minh, or Dong Nai, where many South Korean factories are operating.

From foreign to local – Deepening economic relations

From 2018 to 2020, the State Bank of Vietnam is limiting the percentage of short-term capital lent to mid-to-long term debts from 45% to 30%, meaning many residential projects that have relied heavily on bank’s money now need to find a new source of fund, and here comes South Korean investors to rescue.

Dat Xanh Board’ Resolution to issue convertible bonds to KIS Securities.

On April 10th, the Board of Dat Xanh Group, a leading brokerage and residential developer, approved a US $10 million dollar convertible bond private placement to the South Korean firm KIS Securities.

A few months ago, Hoang Huy also issued US $50 million dollar convertible bonds to a group of investors led by Shinhan, a South Korean bank making aggressive investments in Vietnam.

Thus, the flock of South Korean financial powerhouses into Vietnam (discussed in the second issuance) is a great hydration for the capital thirst of Vietnamese residential developers. On the other hand, it also suggests opportunities for South Korean investors to have a better negotiation leverage and hold stakes in Vietnam’s prime residential projects.

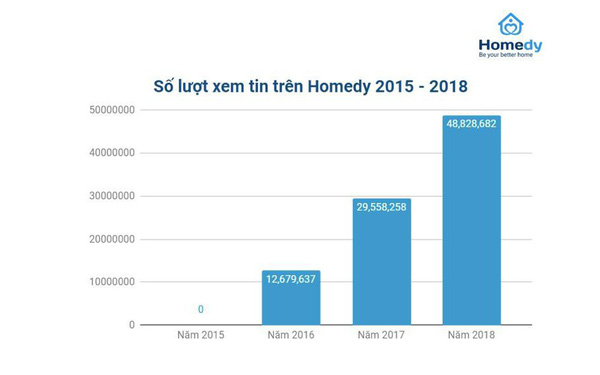

South Korean financial firms went further by funding Vietnamese startups, notably Access Ventures’s investment in Homedy, an online real estate connection platform.

Homedy’s ad views growth between 2015 and 2018. The investment along with impressive ad views growth on Homedy.com depict the liveliness of Vietnam’s property market.

More than venture capitalists, South Korean entrepreneurs took even higher risks by choosing Vietnam to build their dream businesses.

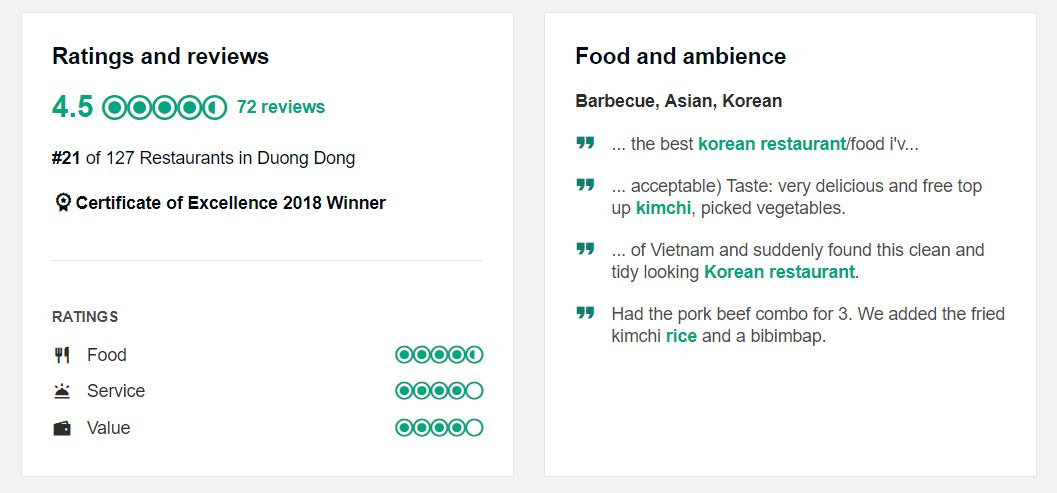

Korea Eats, as the name might suggest, is a Korean barbeque restaurant opened since 2016 on Phu Quoc Island, Kien Giang province.

Korea Eats on Tran Hung Dao Street, Phu Quoc.

The venue is the first South Korean restaurant established by three Koreans who are friends with each other and has received many loves from locals and tourists.

Korea Eats reviewed on TripAdvisor.

A South Korean small business blooming on a rural island in Vietnam shows strong and rising tourism from the East Asia country.

Though travel in general and resort realty in particular are sensitive to economic changes, thanks to several thousands of South Korean visitors every season, Vietnam’s tourism has been alive and well. That has helped leisure property owners in South Koreans’ destination wish-list like Phu Quoc, Da Nang, or Hoi An to prosper; therefore, investors who are willing to take on slightly higher risks should give an eye on leisure estates in those hotspots.