44 real estate firms issued VND47.8 trillion ($2.06 billion) worth of bonds between January and August, according to a recent report by stock brokerage firm Saigon Securities Inc.

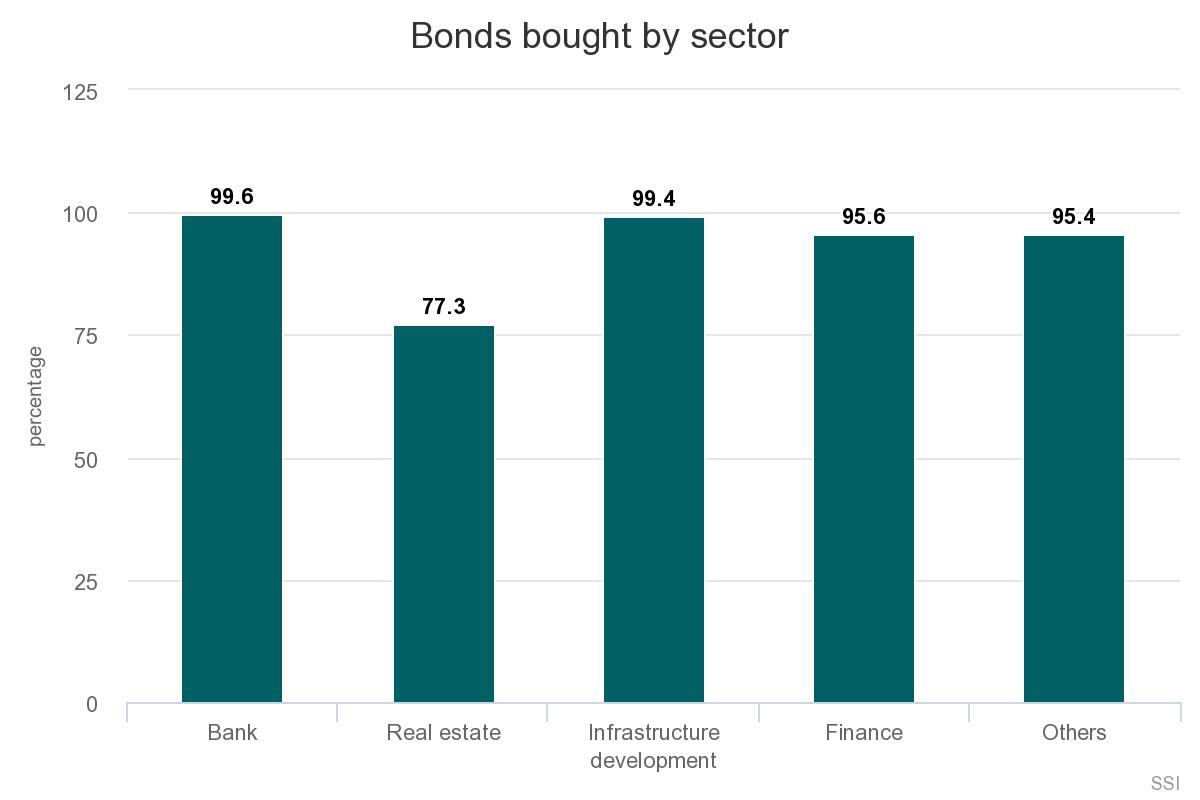

Although real estate bonds have an average interest rate of 10 percent a year, higher than that of bank bonds at 6.7 percent, the later still had a success rate of 99.6 percent, the report said.

One example was the VND5.3 trillion ($229 million) bond issuance by real estate firm An Quy Hung earlier this year, in which not a single bond was acquired despite interest rates of up to 12 percent a year.

Experts said the high risks associated with real estate businesses make investors reluctant to buy their bonds.

Economist Nguyen Tri Hieu said that a real estate company could go bankrupt any time because their capital could run out. "The sudden rise and fall of land prices do not give investors much security," he told VnExpress International.

Other experts said real estate firms cannot attract investors merely by offering high interest alone. They noted that most banks, who are generally big bond buyers, tended to avoid the real estate sector and make their purchases from other banks through stock brokerages, considering those more secure and less risky.

The State Bank of Vietnam last month ordered commercial banks to stop purchasing corporate bonds, a move aim to minimize risks and tighten control over real estate sector borrowings.

The value of corporate bonds issued in Vietnam between January-August this year reached VND129 trillion ($5.58 billion), with 90.9 percent of them bought. Bank bonds accounted for 48 percent of the total value, followed by real estate at 31 percent.