Ho Chi Minh City’s future supply will peak in 2021

In the third quarter of 2019, there were over 19,000 primary units, 76 per cent came from newly-launched projects, according to Savills Vietnam. New supply was from the first launch of Vinhomes Grand Park by renowned local developer Vingroup. Pre-launch activities have been ongoing for over two years, resulting in 100 per cent absorption with 40,000 bookings from over 80 sales agencies. Vinhomes Grand Park targets a wider purchaser pool by offering small apartments from 25-30 square metre.

“Strong demand continues in the face of limited supply. With administrative delays preventing new launches then the secondary market has developed quickly.” – Nguyen Khanh Duy, Director of Residential Sales at Savills Vietnam

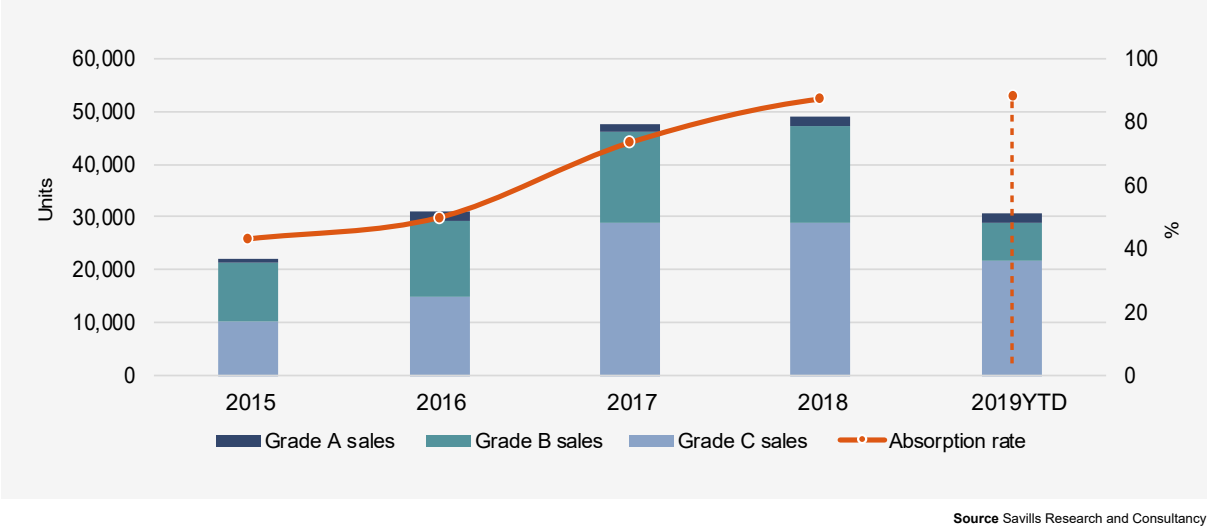

In the first nine months of 2019, there were over 15,600 transactions with 79 per cent absorption. This is a strong improvement compared to the first two quarters of 2019, which had less than 9,000 quarterly transactions. Grade C was the market driver, accounting for 80 per cent of total sales. New Grade A supply such as The Crest Residence (Metropole Thu Thiem) and the next phases of Grand Manhattan and Feliz Somerset had successful launches.

Feliz Somerset project at District 2, Ho Chi Minh City.

Due to state inspections and tightening of administrative procedures, a greater emphasis on obtaining necessary legal documents is now being recognized by residential developers. Over 70 per cent of primary supply was delivered with a Sale Purchase Agreement (SPA). Over 80 per cent of supply has been delivered to owners, indicating a healthy market environment.

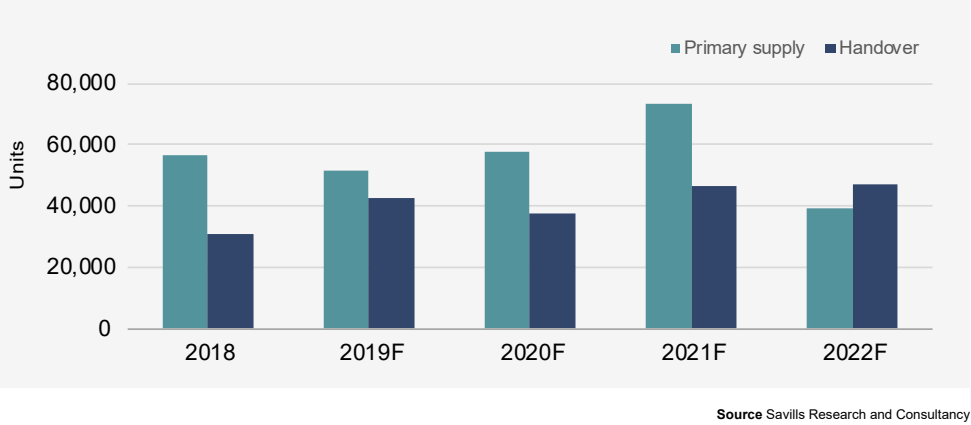

In the last quarter of 2019, over 20,600 units from 30 projects will enter, accounting for 13 per cent of future supply till 2022. The next phase of Vinhomes Grand Park (The Ocean) will provide 48 per cent of future stock. Future supply will peak in 2020-2021 with over 131,000 units. During this period, district 2 and 9 will continue to lead with a 27 per cent and 26 per cent share, respectively.

Big international developers enter Hanoi apartment market

“The high-end segment continues to attract good demand with primary prices increasing favorably, delivering good capital gains for early participants.” – Duong Duc hien, Director of Residential Sales, Savills Vietnam

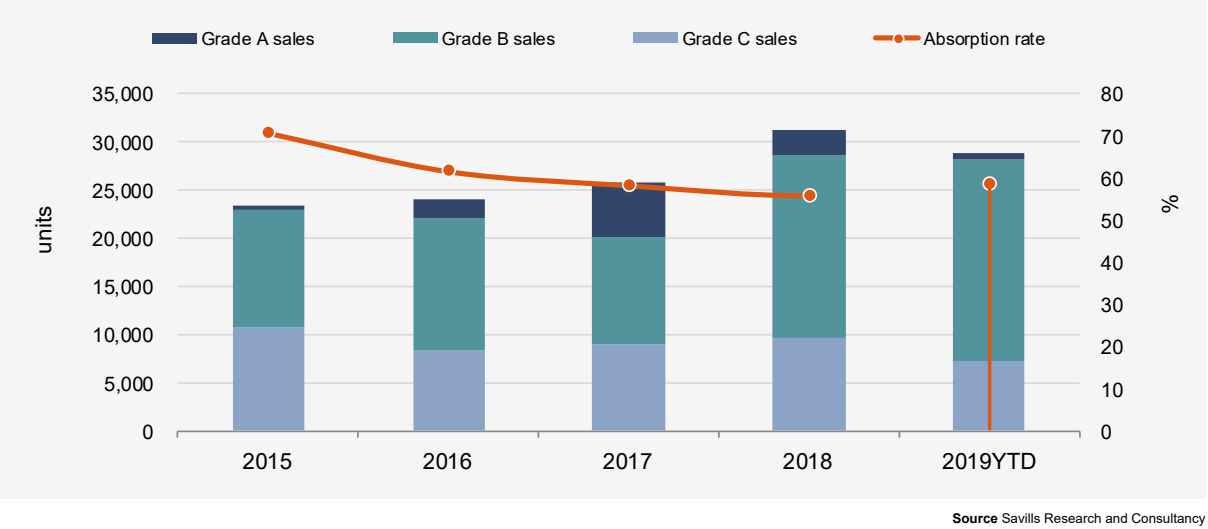

In the first nine months of 2019, eleven new and the next phases of nine projects provided approximately 8,100 apartment units, 23 per cent higher quarter-on-quarter and 17 per cent year-on-year. Primary supply decreased -5 per cent compared to the second quarter but increased 8 per cent than the same period last year, reaching 29,700 units. Grade B remains the largest supplier, accounting for 67 per cent of share.

Primary price improved with a market-wide growth of 1 per cent compared to the previous quarter and 3 per cent to the previous year. Grade A achieved the highest increase of 18 per cent year-on-year mostly due to high prices of newly launched projects. Despite that fact that sales were down -1 per cent than the last quarter, the number of apartments sold in the last three months is 50 per cent higher than the same period last year. Eastern districts including Gia Lam and Long Bien had the highest sales in this quarter with 40 per cent share.

Momentum is derived from golden demographics and a positive economic outlook Hanoi’s population has grown 2.2 per cent pa over the last decade, with approximately 120,000 newborns and 80,000-100,000 immigrants annually. Vietnam’s high-net-worth individuals population is expected to grow at 10 per cent pa for 2018-2023, ranking forth worldwide. The country is also expected to sustain growth rate of 7 per cent pa in 2020s with a surge in GDP per capita reaching US$10,400 in 2030.

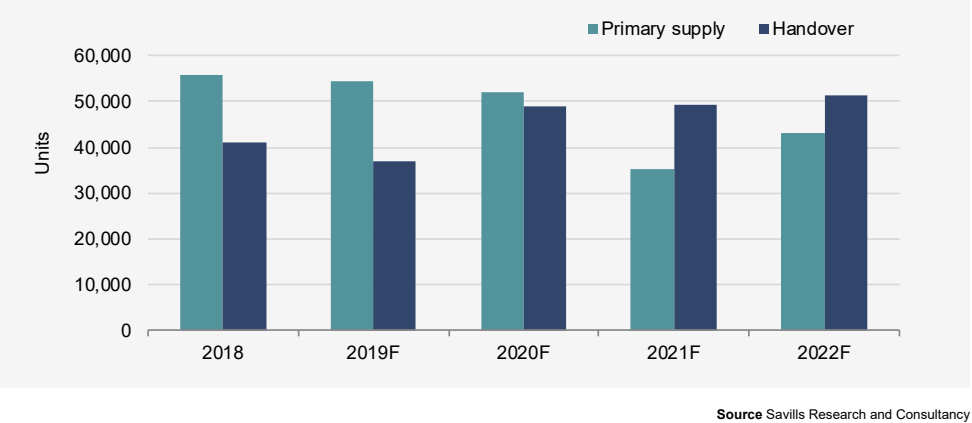

In the last quarter of 2019, approximately 15,800 units from 10 existing and future projects would enter in the last quarter of 2019, according to associate director of research at Savills Hanoi Do Thi Thu Hang. Future supply will spread from urban areas to rural districts. Gia Lam and Dong Anh Districts will supply a combined 30 per cent of share. From 2020 onward, foreign developers including Sumitomo, CapitaLand and Mitsubishi Corporation will enter Hanoi’s real estate market.