Ho Chi Minh City (HCMC) retail demand continued to be dominated by F&B and entertainment

According to JLL, overall leasing demand was stable in 2Q19. A number of malls, after upgrading and repositioning, have recorded significant improvement in their performance. International brands in the beauty and healthcare, sports fashion and chains of coffee shop sectors continued to increase market share. In light of fierce market competition, some shopping malls have consistently put a focus on the F&B and entertainment sectors in an effort to enhance their popularity and increase foot traffic.

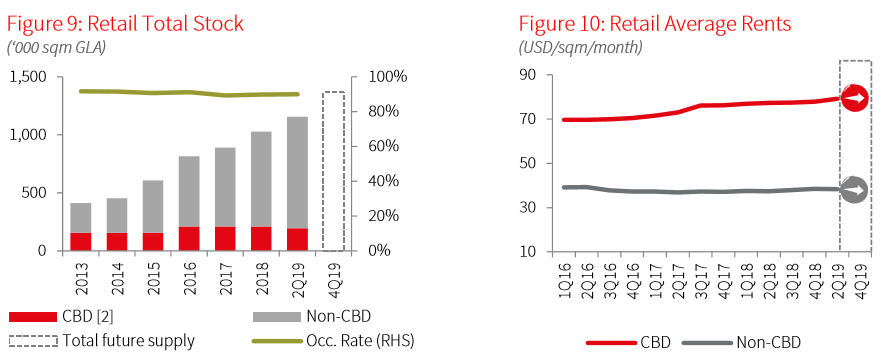

In 2Q19, new supply continued to come on stream in the form of two new shopping centres, namely AEON Mall Celadon Phase II in Tan Phu and TNL Plaza in District 4. Completion of AEON Mall Celadon Tan Phu Phase II with 41,900 sqm pushed the total scale of AEON Mall Tan Phu to 84,000 sqm, making it the largest shopping centre in the city. TNL Plaza is the first retail supply recorded in District 4 with 11,179 sqm of space for lease.

AEON Mall Celadon Tan Phu.

In a continuation of what has been a pervasive trend over the past couple of years, the market share of the department store concept has steadily decreased over the period. In 2Q19, one landlord planned to close down its department store in Tan Binh and another department store in the CBD, Parkson Le Thanh Ton, was temporarily closed for renovation and brand restructuring and is planned to re-open in 3Q19.

In 2Q19, the strongly expanding proportion of non-CBD stock led to a slight decrease on yearly basis in the average rent to USD 45.7 per sqm per month, up 0.7% q-o-q and down 1.8% y-o-y. On a project basis, rents remained stable in 2Q19.

(Photo: JLL Research)

In 2H19, the HCMC retail market is predicted to welcome an additional 210,400 sqm of retail space from five new completions in the non-CBD area. Besides the domination of F&B, entertainment and fashion, demand for retail spaces from the healthcare, education and showroom sectors increasingly plays an important role in supporting the performance of shopping centres across the market.

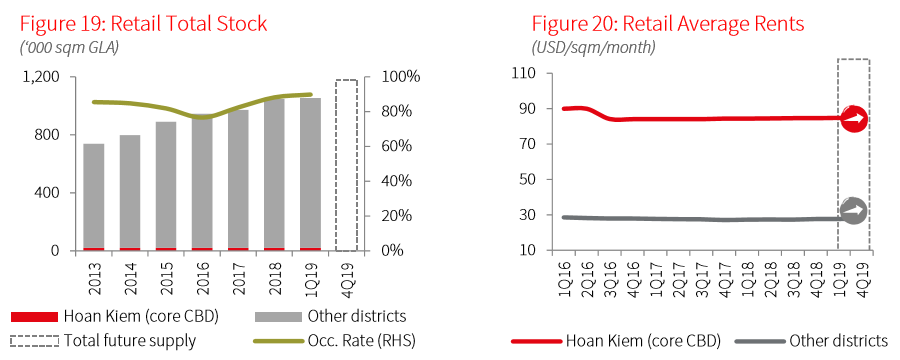

Hanoi new non-CBD completions was quickly taken-up, pushing rental price

The occupancy rate in 2Q19 grew to 92% , up from 90% recorded in 1Q19. Net absorption of approximately 67,000 sqm was recorded, mostly contributed by malls in non-CBD areas. Two new Vincom shopping centres opened nearly fully occupied during the first few months of trade, with less than 5% of space in each centre remaining for letting.

In 2Q19, Vincom opened two new malls in the west of Hanoi: Vincom Center Tran Duy Hung in Cau Giay District with 45,000 sqm and Vincom Plaza Skylake with 13,000 sqm in Nam Tu Liem District. The opening of the two new malls helped to take total retail stock to nearly 1,111,000 sqm, an increase of 5.5% q-o-q and 14.3% y-o-y. With an increasing number of new openings, non-CBD areas account for 62% of total retail supply. This is opposite to the situation in 2Q14 when supply in CBD areas contributed up to 67%. This trend is expected to continue due to limited developable sites in the City Centre.

Vincom Center Tran Duy Hung. (Photo: Kenh14)

The overall market rent was USD 29.3 per sqm per month, increasing 1.6% q-o-q and 2.1% y-o-y. Higher-than-average rent in new completions developed in good catchment areas helped to push the overall market rent upward. While both shopping centres and department stores enjoyed the growth in rent, prime retail space remained relatively stable, since this type of space is quite limited in supply and most of the space has been fully occupied for a long time. Rent in Hoan Kiem District remained unchanged, while rent in the rest of the city climbed up in 2Q19.

(Photo: JLL Research)

As the market is experiencing an upward trend, rent is expected to continue to rise. In addition, an increase in purchasing power from positive economic prospects will help to strengthen the trend.

AEON Mall Ha Dong, the most notable shopping centre, is set to open in 2H19, adding 74,000 sqm to the total Hanoi retail stock. New malls, especially in the outer districts where most future supply is concentrated, will need to prioritise their effort in creating new retail concepts and improving the shopping experience to find tenants to take-up leasable space as well as draw footfall to their malls.