The firm’s fifth annual report titled “Global Transactions Forecast,” jointly released with Oxford Economics, projects that merger and acquisition (M&A) deals will decline globally from the current US$2.8 trillion to $2.1 trillion in 2020. In addition, the forecast also predicts a downward trend in initial public offering (IPO) proceeds from an estimated $152 billion in 2019 to $116 billion next year, a 23 per cent drop.

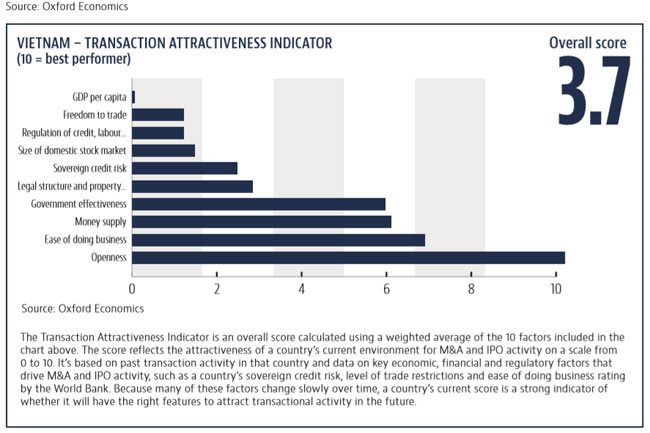

For Vietnam, the forecast expects its gross domestic product (GDP) growth may ease over the next 18 months, due to a drop in export growth trends caused by lower Chinese import demand and increased global protectionism. Currently, Vietnam’s average annual GDP growth of 6.2 per cent is higher than the global average of 2.8 per cent.

Baker McKenzie expects cross-border acquisitions to dominate M&A deals in the coming years, as the country’s solid socio-economic fundamentals continue to attract overseas investors.

“Vietnam remains active in M&A right now, due to positive market factors and confidence that help create business opportunities as well as multilateral agreements that continue to prompt regulatory reform,” Seck Yee Chung, who heads Baker McKenzie’s M&A practice in Vietnam, said in the report.

Vietnam, Thailand and Indonesia were considered in the report as Asian countries that saw strong inbound activity in 2019. This year’s largest cross-border signed inbound deal in Vietnam was South Korea-based chips-to-energy conglomerate SK Group's US$1 billion investment in Vingroup, Vietnam's leading diversified business group. This was followed shortly by South Korea-headquartered Hana Bank’s purchase of a 15 per cent stake in the Bank for Investment and Development of Vietnam (BIDV) worth US$850 million. South Korea is the largest source of foreign direct investment in Vietnam, as the latter has become a production base for major South Korean multinationals such as Samsung and LG.

Despite continued interest from investors, Vietnam may experience a decline in M&A, as total transactions will dip from the current $2.6 billion to $1.7 billion next year, a 35 per cent decrease. In IPOs, the report did not post any estimates for 2019-2020.

However, looking ahead, the report predicts that activity will pick up again post-2020, as Vietnam remains an attractive market.

Asia Pacific sees more declines in 2020

In Asia Pacific, the report predicts M&A activity declining 18 per cent from $634 billion in 2019 to $529 billion in 2020, and IPO activity will likely continue its slower trend from this year, which is expected to amount to $36 billion, a 43 per cent decline from 2018. IPO proceeds are predicted to dip even further to $33 billion in 2020.

The region’s weaker performance in 2019 can be attributed to a reduction in Chinese outbound deals due to government restrictions on outward investment. On a broader scale, this in turn may dampen economic momentum across Asia Pacific.

“Make no mistake - deals are getting done, but the current slowdown is inevitable, considering the continuing uncertainty around trade and regulation,” said Ai Ai Wong, chair of Baker McKenzie’s Global Transactional Group. “We know that around the world, there are many investors and companies with capital on the sidelines, waiting to move forward with domestic and cross-border deals.”

A range of upside and downside risks could impact the global economy and lead to a rise or drop in deal values and volumes that differ from the central transactions forecast presented in this report. To explore both upside and downside risks, the report looks at five different economic scenarios: Trade War Escalation, Protracted Eurozone Slowdown, US Recession Hits the Global Economy, No-deal Brexit, and Trade War Fears Fade.

To understand how these hypothetical outcomes might impact the global economy and the implications for deal making, you may view the interactive Global Transactions Forecast tool http://interactive.globaltransactionsforecast.com.