Slow licensing process in HCMC will challenge the launching of new projects.

Leveraging opportunities from stable domestic demand and increasing foreign interest

Demand for housing in Vietnam, especially in HCMC and Hanoi, is rising due to high pace of urbanisation. According to the World Bank, with the current trend of urban migration in Vietnam, the share of urban population is expected to reach 50% by 2040. Additionally, the steady growth of population in Hanoi and HCMC of average 2% per annum each city as seen over the past five years will drive constant housing demand.

Overseas demand was fuelled by FDI inflow. Vietnam is expected to benefit from the recent US-China trade conflicts and the relocation trend of factories from China to South East Asia countries. This leads to the growth of expat communities in Vietnam.

Vietnam condominium market is becoming more attractive for both end-user and investor demand, especially in the context that regional markets are more tightened to foreign buyers while Vietnam is recently opening up.

High demand is shown in the number of pre-sale reservations – especially at certain high-end and luxury projects where the number of reservations is recorded double or four times higher than the expected new launch units. This trend is mostly seen in projects at prime locations.

Infrastructure improvement and master planning support decentralized trend

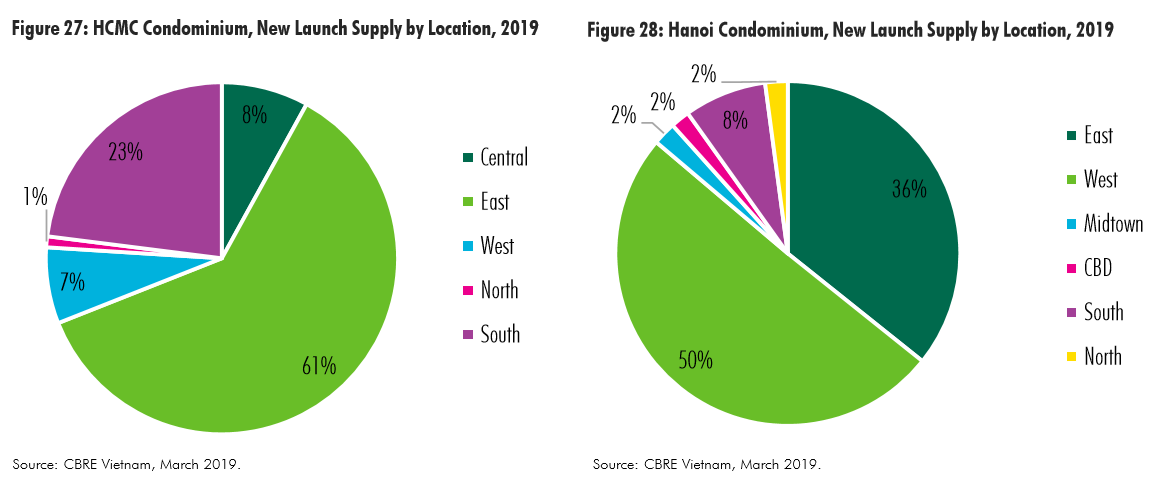

The Hanoi and HCMC markets have been expanding further away from the core districts with significant improvements in infrastructure including upcoming completion of the Metro line No. 2 in Hanoi and Metro line No. 1 in HCMC.

There are still some issues on funding for infrastructure projects leading to long delay of key projects such as Metro line No. 1, 2 in HCMC and 3 in Hanoi as well as flooding presentation system. Meanwhile, progresses in Metro line no. 2A and elevated Ring Road 2 in Hanoi brings better outlook for projects in surrounding areas.

HCMC adjustment of land use planning: HCMC government announced the government’s Resolution 80/NQ-CP, dated 19 June 2018, on adjusting land use planning until 2020 in HCMC. New land bank for residential development will be added in decentralized area. This will support the current trend of development that developers need to go further for land bank.

Condominium restriction in HCMC leads to lower new launch supply

HCMC to restrict condo developments in downtown area until 2020: According to the HCMC’s housing development plan between 2016 and 2020, new housing projects cannot be developed in the centre area including District 1 and 3. HCMC will be more selective in choosing high-rise condominium projects.

Project investigation and reclaiming “long-pending” projects to control the quality of projects and avoiding the vacant land plots in prime location across all the city.

These actions from the government leads to a reduction in new launch supply in 2019. Low period in 2019 will allow the market to absorb the remaining stock. Developers also review their product strategy to meet buyer’s needs.

Concerns on ownership for hybrid products and to foreign buyers

While hybrid products such as office-tel, condo-tel, shophouse at condominium podium have been introduced to the market for a while, the lack of legal framework backed up for these products has posed risks for buyers. The lack of legal framework might negatively impact on the marketability and stability of these product types.

Concerns on condominium title and paperwork for foreign buyers were addressed to a certain extent by the various city governments in 2019. In February, Department of Construction of Da Nang City announced 17 projects that are allowed foreigner to receive pink book. In March, Department of Construction of Hanoi approved for one project to sell to foreign buyer. This is a positive news for foreign buyers that their concerns will be solved. The market is looking forward to this list extended in other cities, especially HCMC. This concern has been affecting foreign buyer decisions even though market still records high interest from this group. Prime location projects reached 30% quota for foreign buyers quickly. Secondary market for this group is also more dynamic due to limited supply.

Opportunities for better products amid increasing competition

Expansion and New entrance: Local developers showed aggressive move in expanding their land bank to other provinces from their core markets. There have been increasing new developments in second-tier cities such as Bac Ninh, Hung Yen in the North and Dong Nai, Long An in the South showing strong expansion of residential markets. Meanwhile, developers based in Hanoi also find new opportunities in HCMC and vice versa. At the same time, foreign developers look for partnership with local players with main focus on HCMC and Hanoi. Given the more active participants of both local and foreign developers, it is expected that better product quality and new features will be introduced to the markets.

Competitive rental market: Handovers of completed units lead to growing competition on the rental market especially in Binh Thanh District and District 2 area in HCMC and the West area of Hanoi. Short term leasing platforms (such as Airbnb) have proved a popular channel for residential leasing, with potentially higher short-term rates than traditional lease terms, but typically requiring better management and more frequent housekeeping.

Last but not least, land prices for both development sites and land plots are increasing. While developers might enjoy the latter, they also have to cope with challenges from the former. The market is expected to see further segmentation of residential product types, from affordable condominium units, to high value villa units, catering to the increasingly broader demand spectrum.

Outlook

Slow licensing process in HCMC will challenge the launching of new projects while Hanoi to see level of new launch supply to sustain

Strong demand from first home buyers across the major cities, while investment demand is increasing from foreign buyers. Local investors to look outside of the two major cities for new opportunities.