Southern and Eastern Ho Chi Minh City (HCMC) will become condo hotspots in the next quarter

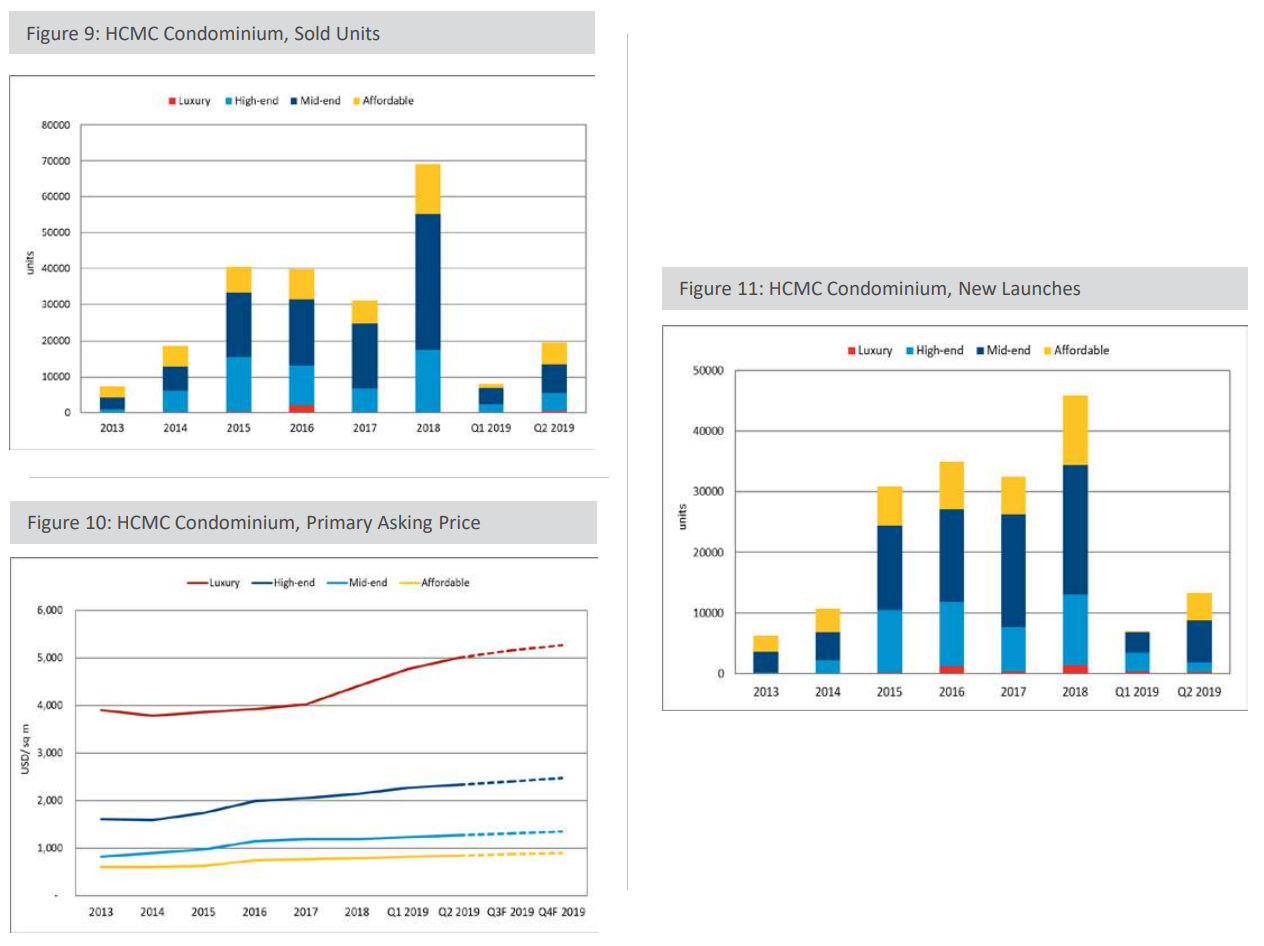

According to market research firm Colliers International, the condominium market in HCMC continued to move slowly in 2Q2019. While the mid-end and high-end segments performed on par with Q1 2019, the luxury and affordable segments continued to account for less than 20% of all recorded condominium transactions so far in 2019. The mid-end segment remained the most soughtafter with more than 1,000 units transacted, followed by the high-end segment with almost 8,000 sold units. The luxury and affordable segments combined accounted for less than 25% of the recorded transactions in 1Q2019. The Government Inspectorate of Vietnam has recently issued a decision on the wrongdoings of multiple developers in the Thu Thiem New Urban Area. This is particularly positive for the luxury segment in the condominium sector in HCMC, which can expect additional high-priced supply to be delivered within the next couple of years. The primary price of condominiums continued to increase, although only incrementally. The high-end and luxury segments recorded the largest increases – 5.5% and 8.5%, respectively. The mid-end and affordable segments increased in primary price by a small amount.

The most notable new supply to the condominium market in HCMC in Q2 2019 was The Marq by Hong Kong Land. This project will bring 515 condominiums and penthouses to discerning buyers. Aside from The Marq, the condominium sector saw subdued activities in Q2 2019. Multiple projects which have been in development for longer are edging near completion. The South of HCMC has seen a rise in the number of condominium projects from major local developers including Sunshine Group and An Gia Investment. By the end of Q2 2019, there were more than 20 thousand condominium units available for sale in HCMC.

The Marq by Hong Kong Land.

With land prices in HCMC increasingly out of reach for the majority of the public, the general public is becoming more receptive to condominiums. Young families, in particular, are attracted to condominiums due to their relative affordability compared to landed houses. Condominiums are gaining popularity among all segments of the public due to their relative affordability (compared to landed properties), higher liquidity, and convenience. Also, condominiums are becoming decentralized, and more developments are located further from the city center.

The market is expected to continue to be vibrant in the next quarter with many launches. For the foreseeable future, the Eastern and the Southern areas of the city will remain as hotpots of new developments, thanks to the expansion of HCMC metropolis and well-established infrastructure.

(Photo: Colliers International Research)

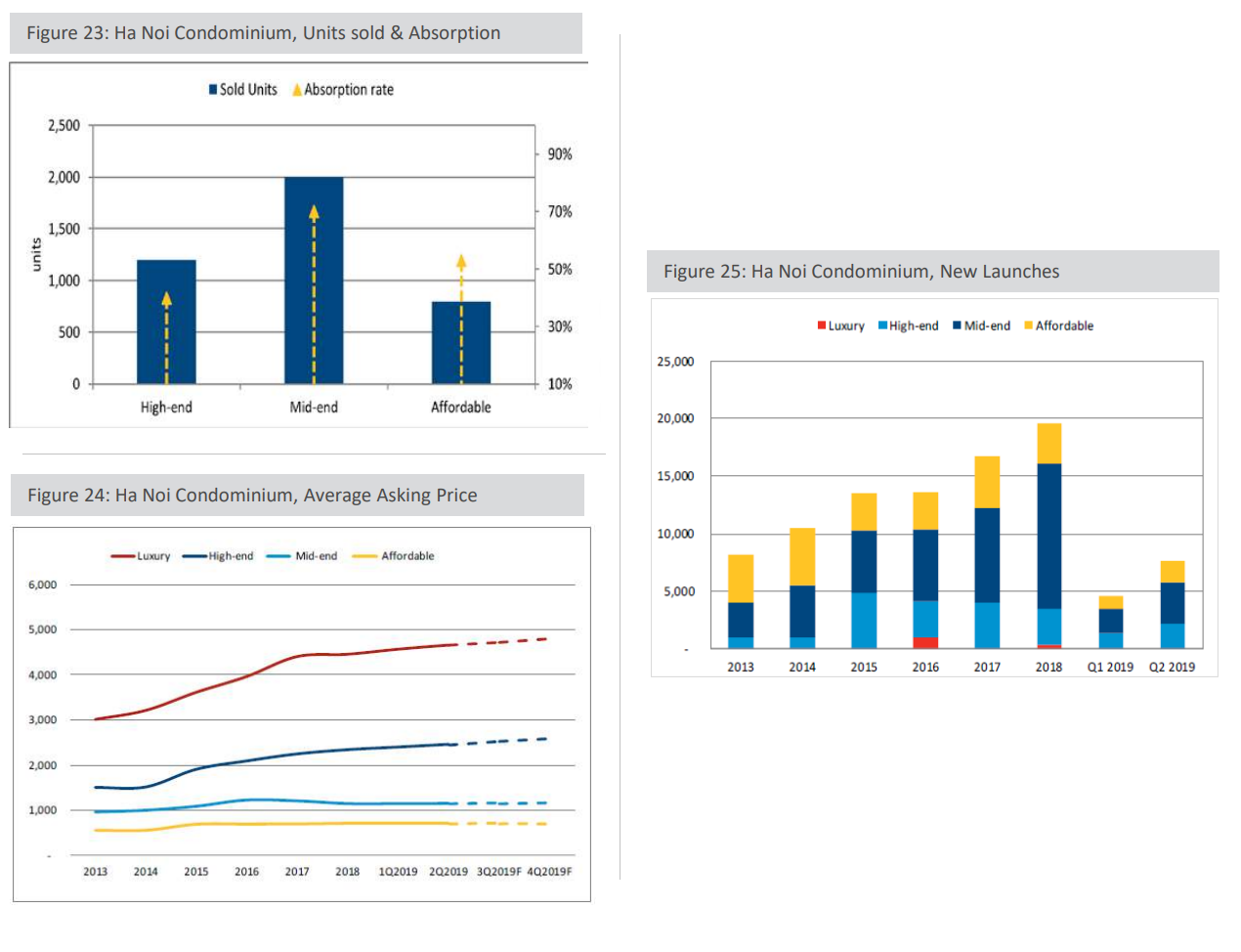

Hanoi condo market shows a strong emphasis on affordibility

In the second quarter, the number of sold units plunged by more than 14.5% q-o-q with approximately 4,000 successful transactions. The mid-end segment continued to take the largest proportion in the new supply at 45%, followed by the high-end at 30% of total supply. No new luxury apartment was absorbed while affordable segment witnessed a moderate sales volume with nearly 750 units. On the primary market, developers offered relatively stable selling prices to prepare for upward price adjustments often occurring in the end of year. Therefore, selling prices recorded minor changes in the second quarter with the average price of approximately USD1,850/sqm across all segments.

(Photo: Colliers International Research)

The second quarter ends with approximately 7,500 units were launched, up 48% q-o-q. The market has shown a strong emphasis on affordability as there was a shift from high-end to mid-end products. The mid-end segment accounted for nearly half of the total new supply in Q2 2019, followed by the high-end segment with 2,000 units, making up 30% of the total newly launched supply. In Hanoi, the luxury segment is quite small and prices were stable. The mid-end and affordable segments were more competitive because of the large demand in the market, so selling prices fluctuated. Hanoi condo market is still lacking in affordable apartments, developers still prioritize high-end and mid-end segments with high demand.

Mid-end and affordable segments have a high number of end-users who buy house for living purpose in primary market. The number of end-users in affordable segment is always higher than others. Buy-to-let and buy-to-sell have become the popular investment forms these recent years. For mid-end segment, returns from leasing are expected to range from 5% to 8% per year. Buy-to-let is a preferred investment form than buy-to-sale, characterized with high stable returns. The price of apartment typically goes up only in two occasions which are apartment handover period and issuance of the Land Use Right & House Ownership Certificate. Hanoi apartment market in the second quarter is positive. The mid-end projects and affordable projects in the western and southern district have a higher transaction volume than projects in other regions. Typically, in June, Hoa Binh Green City, Phuc Thinh Tower, HUD3 Tower with an average price of about US$1,000/sqm got high absorption rate.

Hoa Binh Green City.

In upcoming years, as more mid to low end housing projects will be added to the future supply pipeline, sale price will not see a notable appreciation for this market segment. Non-urban districts such as Hoang Mai, Ha Dong, Dan Phuong and Gia Lam are being major hubs for lower-end residential products thanks to their large land availability. The existing gap between strong end-users’ demand and limited mid to low-end segment still maintains its leading position. The market is expected to welcome more foreign buyers.