Huge surge in start-ups

The massive demand was largely due to a solid rise in the number of newly registered enterprises. Nationwide, there were 28,541 freshly established companies nrecorded in the first months of 2019, up 6.2% regarding the number of companies, and 34.8% regarding registered capital from the same period in 2018.

The registered capital hit a new level at VND 13.2 billion per newly established firms, up 26.9%. During the 1Q19, the number of new businesses in the real estate sector recorded at 1,548, grew 26% year-on-year and accounting for 5.4% of the total newly registered enterprises.

Vietnam office market is on the rise. (Illustrative image)

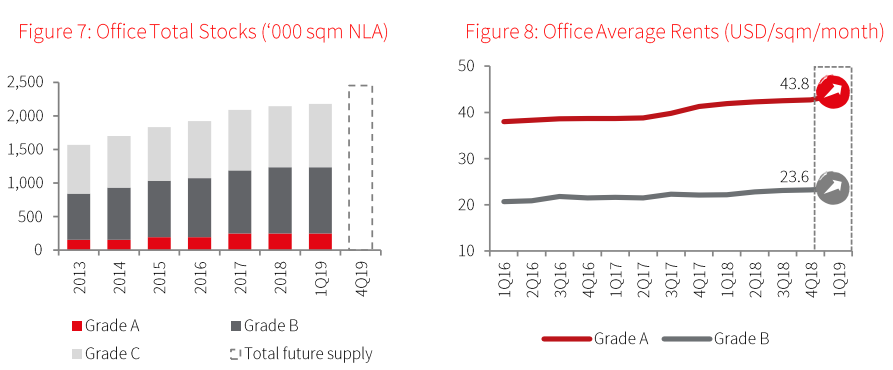

According to JLL’s Property Market Brief 1Q19, the office market of HCMC was in the ever-rising stage of the rental cycle. Average rental rate of Grade A and B offices stood at USD $27.9 for each square meter every month and rental growth was 1.8% quarter-on-quarter and 5.4% year-on-year.

Strong demand

Demand remained positive during the quarter, on the back of limited supply, resulted to occupancy rate up to more than 96% as at end of 1Q19.

Demand continued to come primarily from services; financial and manufacturer continued to dominate leasing demand in the market. Flexible space operators have been a major source of office demand as they sought to expand their operations across the city. Corporates have been increasingly embracing a flexible workingh culture to attract young talent.

No new high-end supply

In 1Q19, Grade A and Grade B stock remained stable as no new supply entered into the market. Meanwhile, Grade C start the new wave supply of this year by welcoming four new buildings in District 3, Tan Binh and Binh Thanh, added 16,000 square meters to total current stock.

As at end of 1Q19 total current stock of HCMC office market was over 2,178,000 square meters.

Ho Chi Minh City office market performance. (Photo: JLL)

Rents show a moderate upward tendency

Rent growth was driven by healthy demand for a seventh consecutive quarter, amid tightening supply.

Stronger rental growth was recorded in Grade A with a notable rise of 2.7% q-o-q. Meanwhile, Grade B rose to USD $23.6 per square meter per month, up 1.3% q-o-q, partly due to the expected influx of new supply in this segment.

Outlook

Vacancy is expected to increase as a large volume of new stock is set to enter the market. The robust growth of flexible space recently to provide various diversified options for tenants also likely put further pressure on filling up the new office properties.

Demand continues to pick up on the back of positive economic prospect. While higher rent is expected in new completions with better quality and project design, the new supply expected in 2019 may put some downward pressure on HCMC rents. Accordingly, developers should be flexible in leasing strategy to capitalize on the market.

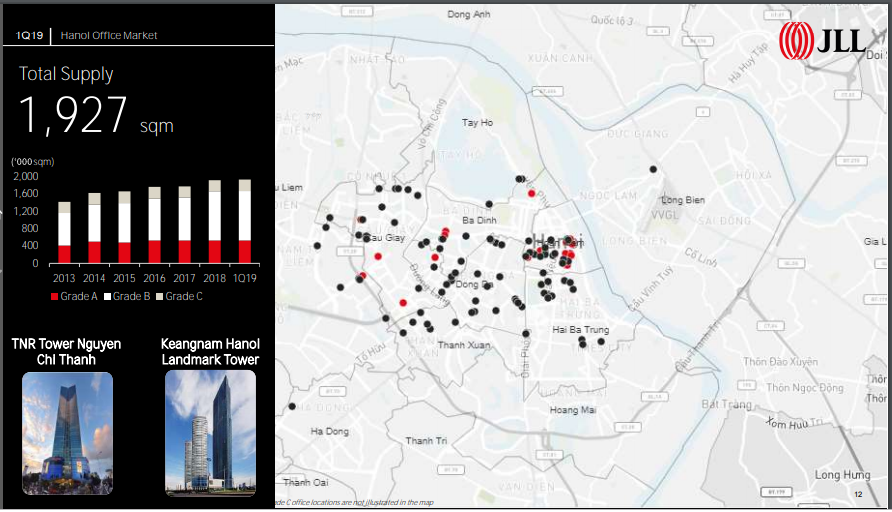

Office supply in Hanoi in 1Q19. (Photo: JLL)

Meanwhile in the capital city Hanoi, the office market had a solid start to 2019, led by expansion and relocation enquiries. The segment had though passed the rising stage and moved on to the slowing period of the rental cycle. The market witnessed a particularly modest rental growth of 1.5% y-o-y, with average rental rate of Grade A and B offices stopped at USD $21.1 per square meter per month.

Healthy demand continued in the 1Q19

The office market of the Northern city saw 29,613 square meters absorbed in the 1Q19. The most significant gains of more than 27,000 square metes were recorded in non-CBD area. As of end 1Q19, the occupancy rate of Hanoi office market stood at 94%.

Slight increase in supply

In 1Q19, Hanoi Grade A and B office stock remained unchanged at approximately 1,668,000 square meters. The Grade C office market welcomed a new project in Hoang Mai District, bringing Hanoi total office stock to nearly 1,927,000 by end 1Q19.

The office market supply was still concentrated in the CBD area, including Hoan Kiem, Ba Dinh, Hai Ba Trung and Dong Da districts, with more than 1,152,000 square meters, contributing nearly 60% total office space.

Rent grew steadily

Given positive demand and relatively low vacancy in the office market, the average gross rent continued to increase by 0.4% q-o-q and 1.5% y-o-y.

The average rent for office buildings in the CBD was recorded at USD $24.2 per sqm per month, up 0.5% q-o-q. During 1Q19, the non-CBD sub-market inched up by 0.2% q-o-q, attributed to the higher rents in newly completed buildings.

Outlook

A wave of new supply is set to enter the market during 2019. Thai Square is set to come on stream in 2Q19, adding 25,000 sqm to the total premium office stock. Until the end of 2019, among 12 buildings expected to come on stream. Over the remaining of 2019, Thai Square is the only Grade A building.

The expected notable increase in supply in near-term will likely put downward pressure on rent. While average rent in prime location may experience further rental improvement, the non-CBD area with higher available space is anticipated to soften. The overall market rent will continbue to move in an upward trend.