By Le Trong Hieu Director, Advisory and Transaction Services, CBRE Vietnam.

In general, Southeast Asian sectors have achieved substantial growth thanks to dedicated support along with the domestic protectionist policies of its respective governments.

In Vietnam, rapid changes in regulations and trade have had a significant impact on the market. From the real estate perspective, the most important aspect for market shift and macroeconomic conditions is the increased demand and expansion of industrial production. In fact, there have been major industrial and commercial lease deals related to the sector over the past three years with the anticipated demand for lease extensions. High occupancy and rising rental rates are challenges for expanding production. However, this could also be an opportunity for real estate developers to note the increasing demand for production expansion amid the current limited supply.

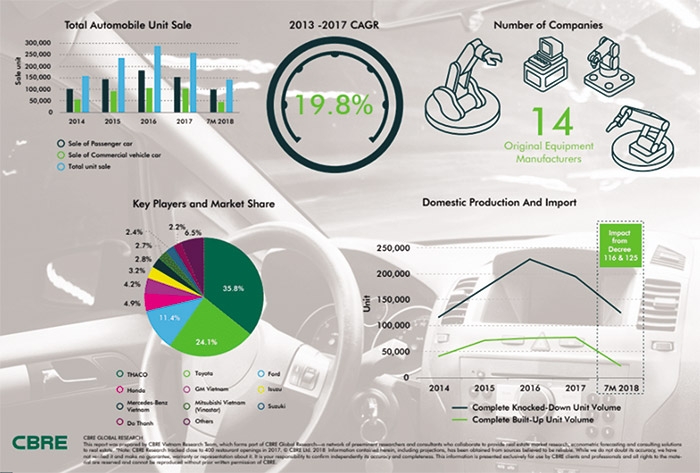

Since the beginning of 2017, the Vietnamese automobile market has witnessed a series of significant events. The most important were the arrivals of Decree No.116/2017/ND-CP and Decree No.125/2017/ND-CP. These policies were designed to support emerging Vietnamese car manufacturing interests by applying a legal criterion to expand production scale and improve the quality of domestic products.

While the automobile industry in Vietnam is still underdeveloped in terms of production and manufacturing development in comparison to other ASEAN members, the accumulation of industrial land banks for the industry is increasing. At the same time, each region in Vietnam has distinct competitive advantages based on the difference in business and production nature as well as land availability.

Market trends

Huge potential of a growing automobile market attracts more and more foreign investors. Auto part manufacturers are also taking action to join the market. In fact, reported foreign direct investment (FDI) figures have released optimistic signals for the industry. From 2014 to 2017, both registered FDI capital and number of foreign-invested projects rose steadily, of which manufacturing accounts for 52.44 per cent of total projects and 57.72 per cent of total registered capital on average. Automobile trade and repairs, meanwhile, only accounts for nearly 9.42 per cent of total projects, and 1.75 per cent of capital. However, this sector recorded a very impressive growth rate at 15.45 per cent on-year in terms of number of projects. Furthermore, foreign capital flow into the automobile retail trade and repair sector has climbed by 26.6 per cent on-year since 2014, which is firm evidence for increasing interest from foreign investors in Vietnam’s automobile industry.

Regulations and standards

An effective time length of Decree 125 is considered quite short and fairly rushed for local assemblers and manufacturers to exploit its benefit. Based on the regulations and manufacturing capability of assemblers, only three automobile corporations can fulfil the producing conditions in the meantime - Truong Hai Automobile Corporation (THACO), Toyota Vietnam and Hyundai Thanh Cong, who are major players in the market. In terms of sales units, THACO average 38 per cent of the Vietnamese automobile market, while Toyota Vietnam has approximately 25 per cent share.

Foreign automakers such as Toyota and Honda have been expected to withdraw from or at least reduce production scale in Vietnam. Alternatively, they are going to switch their business strategy to complete built-up (CBU) trading rather than automobile assembling. They invested significantly into factories in Thailand and Indonesia to make use of the ASEAN Trade in Goods Agreement’s regulations. Furthermore, assembling costs of an automobile unit in Vietnam is higher than that of Thai or Indonesian factories due to a very low localisation rate. Decree 116 almost shut the door for CBU into Vietnam in the first three months of 2018. Likewise, Decree 125 is seen as leverage for the local industry by using tax incentive methods.

Industrial potential

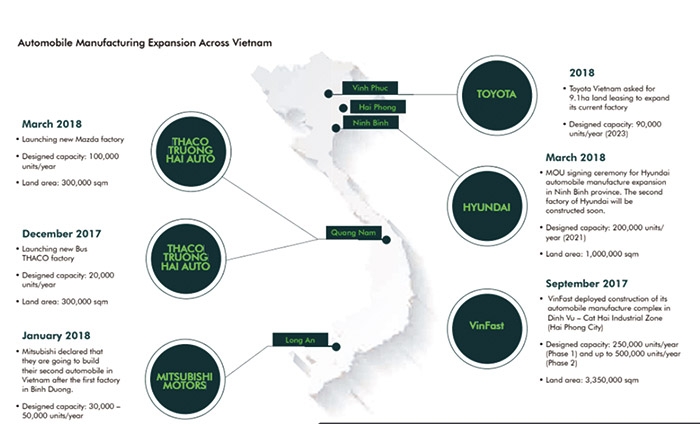

There are 451 automobile plants in Vietnam including completely knocked down (CKD) assembling and auto part making. They can be found across Vietnam but not equally distributed. About 60 per cent of production lines are located in the north and mainly in Hanoi, Hung Yen, Vinh Phuc and Haiphong, where most of very well-known original equipment manufacturers (OEMs) place their factories such as Toyota, Honda, and Ford.

The central region, on the other hand, is the least preferred region for car assembling and auto part manufacturing. However, this started to change with the significant growth by the Chu Lai – Truong Hai automotive complex in Chu Lai Open Economic Zone in Quang Nam province. Together with the newly-launched VinFast automobile complex in Dinh Vu – Cat Hai Economic Zone in Haiphong under rapid construction, THACO’s complex in Quang Ngai would be by far the most current car assembly hubs in Vietnam ever invested by Vietnam private groups.

The south, meanwhile, does not have any similarly-scaled auto manufacturing facilities. Most assembly and auto part factories are small and the proportion of automobile-related factories in IZs are relatively low. Mechanics and automobile-related companies accounts for about 15 per cent of total tenancy in IZs of Binh Duong and Dong Nai. Ho Chi Minh City has the highest rate of these among southern provinces, at about 23 per cent. Meanwhile, Long An’s figure is the lowest.

The Vietnamese automobile industry still has much to do to reach a golden period and compete with regional rivals. The role of policymakers is considered the most vital, but the industry needs more than that to thrive. A win-win relationship herein can be established for both government and real estate developers. The local authorities nurture the domestic industry by implementing protectionist policies, while at the same time creating opportunities for industrial land developers to exploit the expansion in manufacturing as well as business demand. Real estate developers can, on the other hand, offer not only to the government but also to automakers logistics and service solutions for clustering production and supply activities into specialised automobile manufacturing complexes.