Economic Backdrop

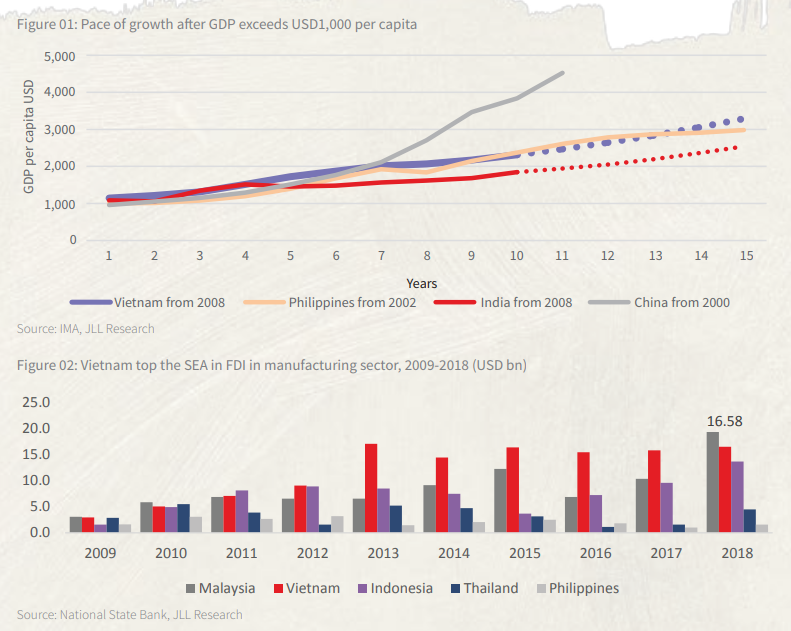

According to a recent report by JLL, Vietnam’s GDP growth in 2018 reached 7.08%, an eleven-year record which surpassed the year’s target of 6.7%. The prevailing transition of economic structure from primary to tertiary industry is expected to result in wealth creation growth, rising consumption, and a growing trained labor force that all bolster the further development of the Vietnam economy. The country’s GDP is set to grow by 6.0-6.5% on average per annum until 2025.

FDI SEA countries have received increasing foreign direct investment, net FDI flow into SEA rose by 11% y-o-y to $150 billion in 2018, outperforming the global figure of minus 5.1% over the same period. With FDI influx exceeding $19 billion, Viet Nam was the third largest recipient within SEA in 2018 and accounted for more than 60% of flows to CLMV countries. This trend is set to continue as escalating U.S. - China trade tensions and increasing cost in China prompt manufacturers to relocate to Vietnam. With 25 FTAs currently agreed, Vietnam is on a journey to become an export-driven economy and one of the most opened economies in the region.

Favorable Demographic Landscape

Excellent Labor Market

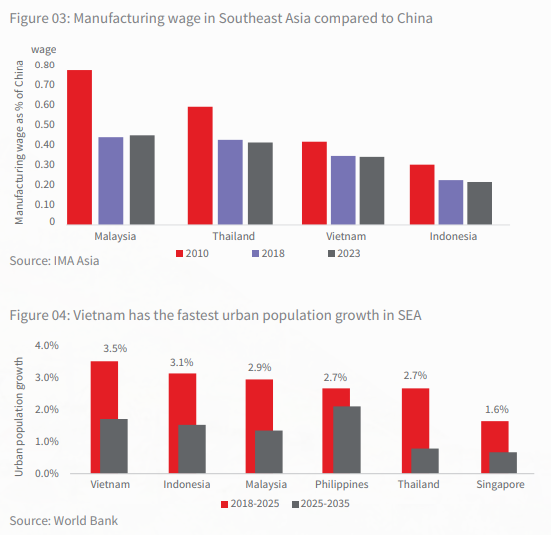

Lower labor costs is one major reason why foreign manufacturers are attracted to Southeast Asia and Vietnam stands out as the country’s labor cost remains competitive when compared to the region. In 2018, the country’s total working population aged 15 or older accounted for 77% total population. For a developing country, Vietnam scores exceptionally well globally on education of the workforce and labor market flexibility. According to IMA Asia survey, Vietnam scores in global standardized mathematics competency tests are in the same level as Japan, Switzerland and Singapore. This generation will be part of Vietnam’s workforce for the next five decades, providing companies the quality talent required for growth.

Urbanization has been constantly improving, particularly in key economic zones that have attracted a large number of migrants from nearby provinces as well as foreigners. Only 36% of population live in cities in 2018, fast forward to 2025, Vietnam is projected to attract 41 million urban residents, 45-50% of total population.

Growing middle-income class

Households earning more than USD 20,000 annually is expected to be seven times higher by 2030 and make up 23% of the population in 2030 compared to just 4% currently.

Vietnam Strategic Location

Located in SEA, one of the fastest-growing regions and in close proximity to major market such as China and India, this S-shaped country with its 3,260 km coastal line offers easy access to a market of over three billion population within five days of shipping or four-hour flight time.

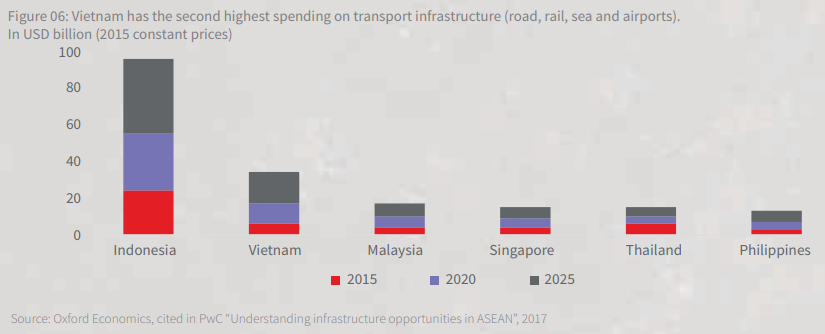

Strong Infrastructure Spending

Vietnam spends 5.8% of its GDP on infrastructure, the highest level in SEA and the second highest in terms of total spending on transport infrastructure. According to the 2018 World Bank report, Vietnam, for the first time, has featured in the top five PPI countries with ten projects at a total of USD 3.4 billion.

Vietnam is playing an increasingly important role in the global supply chain, which has raised the interest of an increasing number of logistic companies, who are eyeing Vietnam as their next port of call.

The country is keen to improve its inefficient port infrastructure to further support its attractiveness. According to Vietnam Maritime Administration, the country aims to achieve the annual throughput of 1,040-1,160 million tons by 2030.

Although the lack of well-developed infrastructure still prevails across the country, constant improvements in the transportation network under the Government’s effort to position the country as a regional manufacturing hub is expected to continue to tempt companies and investors into the country.

Business Environment

Global and regional uncertainty

Amid the ongoing wave of disruption in the global trading system, Vietnam has stood out as the largest beneficiary given its flattering economy, demographics and location.

Free trade agreement

Vietnam is considered as one of the Asian economies most open to international trade. The country’s integration has developed at both regional and global level, supported by the progressive development of WTO and the most recently ratified CPTPP. This underpins the impressive trade results of the country over the past two decades and put Vietnam ahead of its goal of balancing trade by 2025.

Vietnam is poised to be the future manufacturing and logistics heart of Southeast Asia.

Government support

Established itself as an export-driven economy and focused on transforming towards more efficient and sustainable development, Vietnam government has created favorable environment for businesses with business incentives offered within industrial parks and economic zones.

Vietnam has also launched a clear plan on industrial development by 2035. Mechanical manufacturing, Electronics and New energy are three key pillars driving the country’s economy.

Growing demand for logistics services

The robust growth of e-commerce has set a tone for the growing domestic demand for logistics/warehouse properties. In addition, the shift of manufacturers from China to Vietnam, due to its strategic location and competitive labor cost are the key demand drivers for cross border logistics/warehouse services. Mordor Intelligence1 projected the value of the Vietnam freight and logistics market would reach USD 113.32 billion by 2023, reflecting a CAGR of 16.6% over the 2018-23 period. The market is set for strong growth on the back of 1) Vietnam’s export-driven economy; 2) Vietnam’s industrial expansion and 3) The growth of the domestic consumption market