High demand prompts HCMC’s new landed-property supply in H2

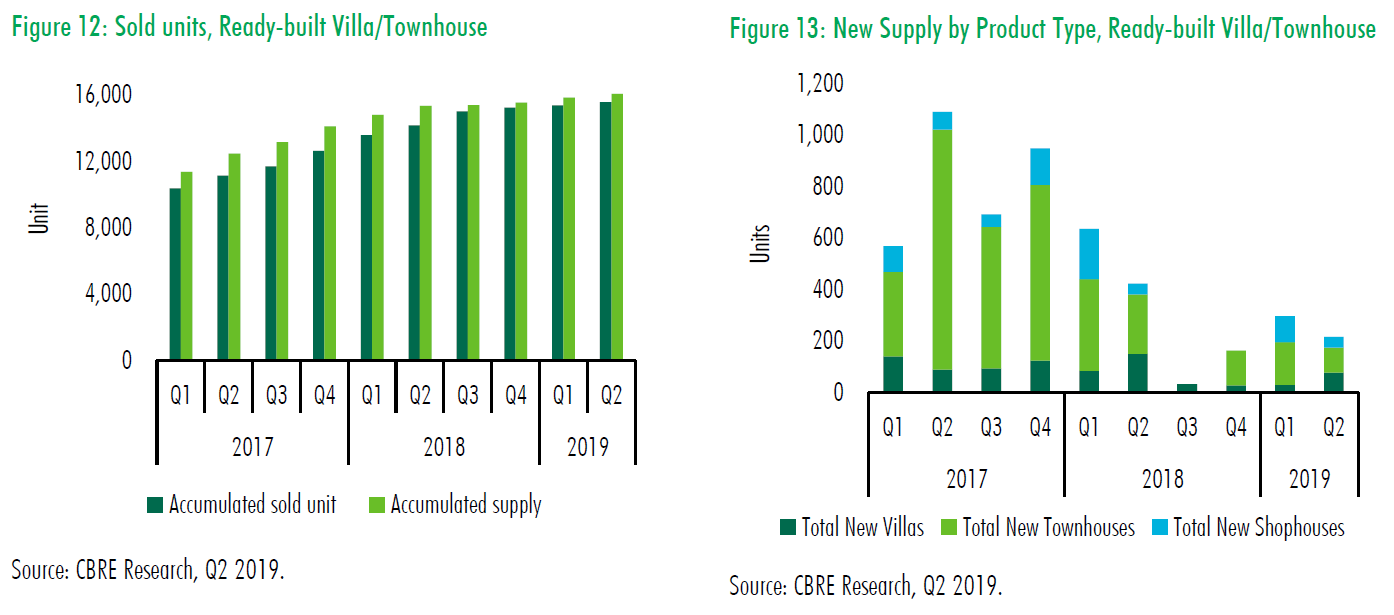

The shortage of new supply in ready-built-townhouse and villa market in HCMC continued in Q2 2019. In the second quarter, HCMC’s landed property market welcomed 216 new units (98 villas, 76 townhouses and 42 shophouses) from three projects (one new launched project and two projects that deployed its next selling phase). Total new supply in Q2 2019 decreased by 27% quarter on quarter and only equivalent to half of new launch in Q2 2018.

The cumulative supply’s growth rate as of Q2 2019 was only about 1.4%. 65% of new launched units were townhouses and shophouses. Notably in Q1 2019, shophouses accounted for nearly one fifth of the total new supply (down by 58% q-o-q) and continued to have very high asking prices. Sold rate of newly launched projects in Q2 2019 was 86%. In general, accumulated sold rate since 2012 (Cumulative sold units / Cumulative launched units) was roughly 96.5% as of Q2 2019.

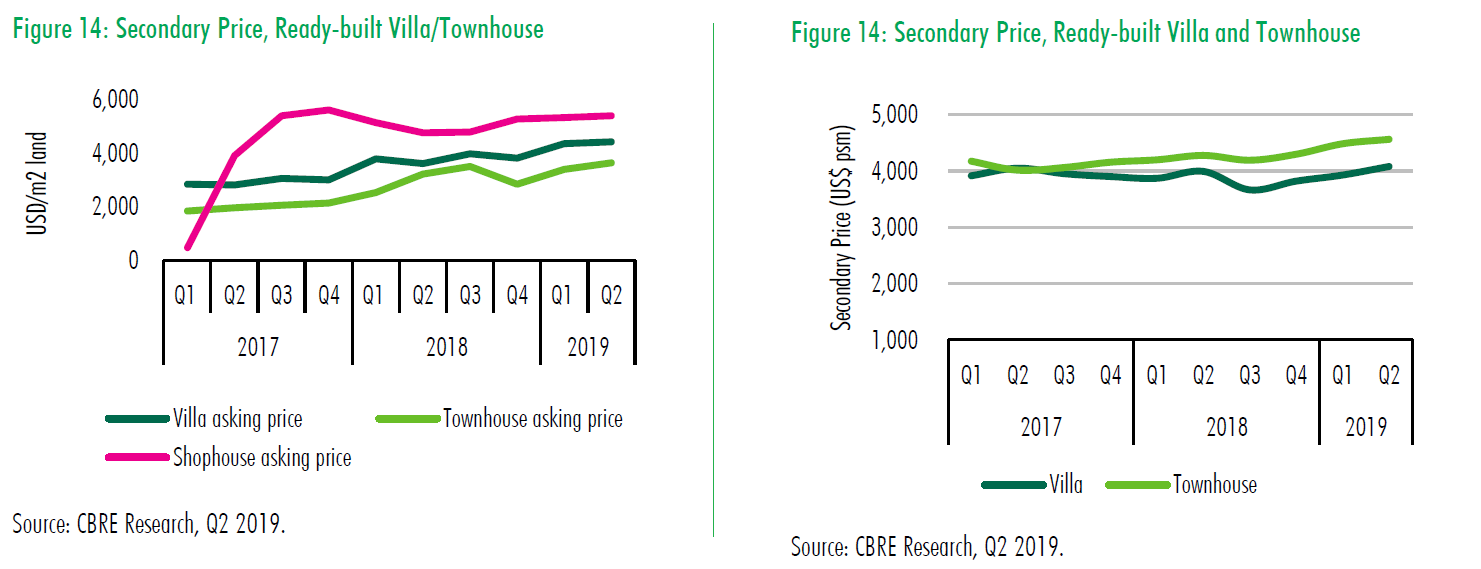

Secondary market remained active in the context of low inventory together with limited new supply. Specifically, asking price of ready-built-villa and townhouse in Q2 2019 went up slightly by 1.3% q-o-q (22% y-o-y) and 7.1% q o q (13% y-o-y) respectively whereas shophouse’s asking price to remain stable compared to Q1 2019 but up by 27% y-o-y. It is expected that the market keeps witnessing the lack of new supply in the last half of the year.

There will be more new launches in the last six months of 2019, about 780 units from three projects in the East and South. However, besides official new launch, developers are promoting their projects with diversified marketing and pre-sale activities or introduce investment contract to the market.

Hanoi landed-property market posts impressive sales rate with new emerging locations

H1 2019 recorded a remarkable figure for new supply of Hanoi landed property market with 3,241 units being launched, primarily due to a strong Q1. Impressive sales performance is achieved during the reviewed quarter despite the massive stock of new launches, which indicates the improving market sentiments for landed residential properties in Hanoi. Approximately 2,980 units were sold during the first six months of 2019 which is 14% higher than the total number of sold units recorded in the whole 2018.

Improving inner-city linkage continues to foster the expansion of Hanoi landed property supply to emerging locations. There has been a major shift of new supply in terms of location, with the East now accounting for approximately 80% of total new launch during the review period. While total supply remains predominantly captured by the West, movements further from the core districts to more suburban areas are being clearly witnessed. Not only does better infrastructure enable the opening of new projects in non traditional areas, but also help revitalize townships that were previously under delayed constructions. Progress has been seen at certain projects to the West of Hanoi, with developers announcing their plans to complete undone constructions and fully deliver high-quality residential developments.

In terms of market performance, secondary price for villas in Q2 2019 averaged US$4,075 per sqm, with VAT and construction costs all included. Having achieved a healthy growth rate of 3.9% q-o-q and 2.2% y-o-y, the figure also returned to the US$4,000-level for the first time after 2 years. This is mainly attributed by rising villa prices in emerging locations such as Gia Lam, Ha Dong and Long Bien areas that are benefiting from bettering infrastructure system and the entering of renowned developers.

Competition in the Hanoi serviced-apartment market will likely be heated

After the second quarter of 2019, Hanoi serviced apartment market did not welcome any additional project, keeping the total supply of over 3,800 units. Regarding supply by location, Tay Ho district continues to dominate the market, with nearby 30% of the total supply. Ba Dinh district ranked second with about 27% of total serviced apartment units.

Grade A segment comprises 72.6% of the total number of units in Hanoi and is mostly located in Tay Ho district. While nearly 30% of grade A serviced apartments are located in Tay Ho district, no project has been recorded in Hai Ba Trung, Dong Da, and Long Bien districts. This trend is expected to continue in the next three years when more future serviced apartments are expected to be open in Tay Ho district. 8 out of 12 future projects are expected to be Grade A and open in this area in the next three years. As a result, the market is forecast to be more competitive with increasing demand for high quality and professional management.

Compared to the previous quarter, Hanoi serviced apartment market recorded a slight decrease of 0.08% in asking rent. Specifically, the average asking rent of Grade A increased by 0.91% to US$33.54/sm/month. Grade B experienced the opposite trend, decreased by 3.87 to US$21.08/sm/month.

In term of occupancy rate, the serviced apartment market showed 2.32 ppts decrease in average occupancy rate, where Grade A and B decreased by 2.49 and 1.87 ppts, respectively.

In the rest of 2019, Hanoi is expected to welcome four new serviced apartment projects, adding over 700 units to the market. These future projects will put more pressure on existing projects’ performance in the coming years.