Hanoi: Busy first half promises positive market sentiment in the last 6 months

In Q2 2019, there were approximately 8,400 units launched in Hanoi leading to a total new launch during 6M 2019 of around 20,000 units – one of the busiest 6M periods recorded. In terms of segment, mid-end and affordable dominated the market covering 98% of total new launch. There were only two high-end projects launched in Q2 2019 in Tay Ho area.

Sales momentum were relatively positive in Q2 2019, with more than 40% of units launched during the quarter having been absorbed. In Q2 2019 there were a total of 9,000 sold units, an increase of 53% y-o-y. Active sales activities and good construction progress from both townships and standalone projects have contributed to overall positive sales performance during H1 2019.

In terms of pricing, selling prices in the primary market in Q2 2019 averaged US$1,337 per sq.m, an increase of 4% y-o-y. Compared with the same basket last year, prices only slightly increased by 1% y-o-y. Noticeably, high-end segment recorded an average pricing level of US$2,345 per sq.m – the highest pricing level of this segment observed over the past five years.

Moving forward, the level of new supply is expected to stay at above 33,000 units in 2019 – a relatively similar volume as seen during 2016 – 2018. Mid-end segment continues to dominate the market with forecasted share to new supply of around 70% - 80%, pointing out that Hanoi market is end-users-oriented. However, products from some township developments have started to draw attention from local investors. While the urban districts are getting more and more crowded, it is expected that residential supply will move further and further away from the 10km radius of the CBD.

Township developments will be the major source of supply providing advantages in terms of integrated amenities and product diversifications. Given the improving infrastructure and recent partnership among major corporations, it is expected that these projects will draw more market attention in upcoming years.

HCMC: Dynamic market in the second half thanks to large-scale projects

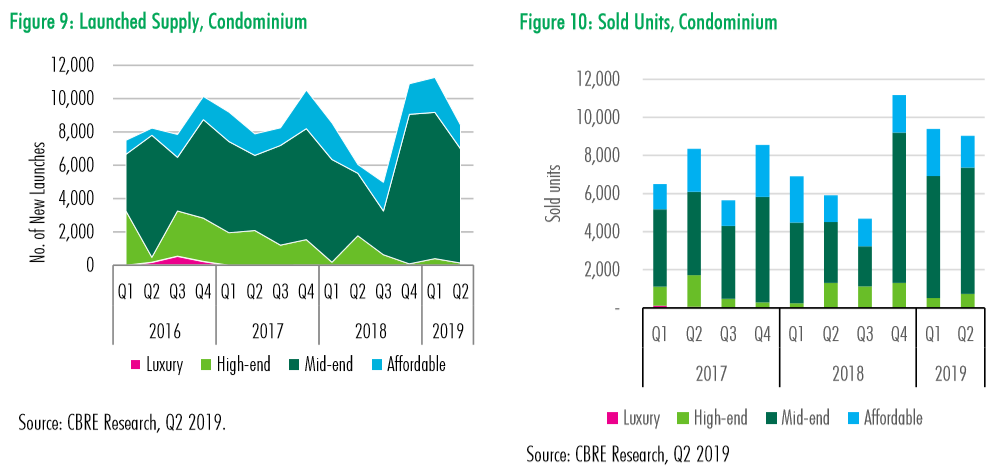

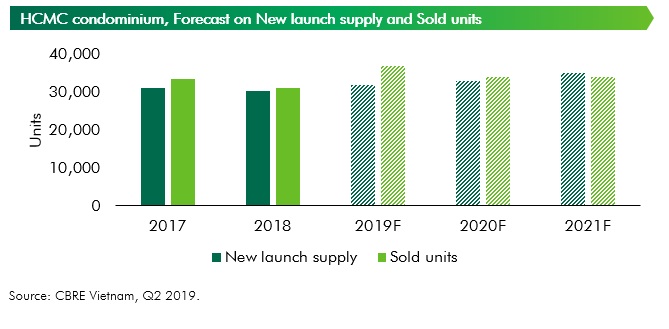

In the second quarter of 2019, due to slow licensing process since last year, new launch supply continued to drop to the lowest number in the last five years. There were 4,124 units launched from 10 projects in Q2 2019, a decrease of 7% q-o-q and 34% y-o-y, bringing total new supply in six months and accumulated supply (since 1999) of HCMC to 8,547 and 268,135 units, respectively. Despite of limited new launch events, developer actively organised pre-launch, expo and client events to gauge market interests in the first half of 2019. These events are promising a dynamic second half of 2019.

In Q2 2019, there were only two new projects that held their first launching events, which are The Marq (in District 1) and The Signial (a project with 50 years leasehold tenure in District 7). The remaining eight projects launched their subsequent phases. These new launch projects achieved high sold rate, over 80% of launched units, even though their price increased by 5% to 10% compared to the previous launches. Demand remains strong in the market which is witnessed through high interest of the market to pre-launch events in the last six months. Booking rates are high in these pre-launch events, especially, some projects received number of booking higher than their launching plan by 50% to 100%.

In terms of segment, mid-end segment accounted for the highest proportion of new launch units in Q2 at 56%, followed by high-end at 40%. Q2 2019 recorded one new launch in luxury segment which is The Marq with 180 units and launching price around US$7,000 psm. There is no new launch supply in the affordable segment.

Sales momentum continued to be positive in Q2 2019 with more than 80% of new launch units having been absorbed. In Q2 2019 there were 4,576 sold units, a decrease of 23% q-o-q and decrease of 37% y-oy. The reduction in sold units was purely due to a decrease in new launch supply.

Inventory overall in HCMC was absorbed gradually with 2,000 units per year in average for the last three years. There were only approximately 15,000 units remaining in the primary market, accounting for 5% of the accumulated new launch supply (since 1999). The remaining units are mainly from old projects with generally inferior quality (large size units, inferior design and unit layout).

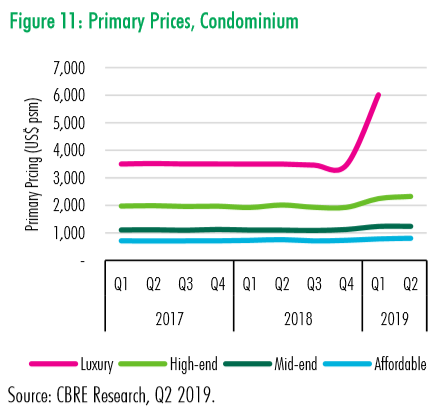

Average price on the primary market was recorded at US$1,873 psm in Q2 2019, an increase of 5% q-o-q and 20% y-o-y thanks to the lack of supply and good sale performance in previously launched projects. Increases in primary price were observed across the market. District 2, District 7 and District 9 recorded highest price escalation of 15%-25% yo-y.

In the last two quarters of 2019, the market is expected to welcome a wave of new launch supply from the East which is led by Vinhomes GRANDPARK in District 9 with over 10,000 units and five new projects in District 2. Other areas also become more active such as the West with AIO City, Akari City and D-Homme; and the South with subsequent phases of Eco Green Saigon, Sunshine City Saigon and new project called Lovera Vista. In total, there will be over 23,000 units launched in the second half of 2019.

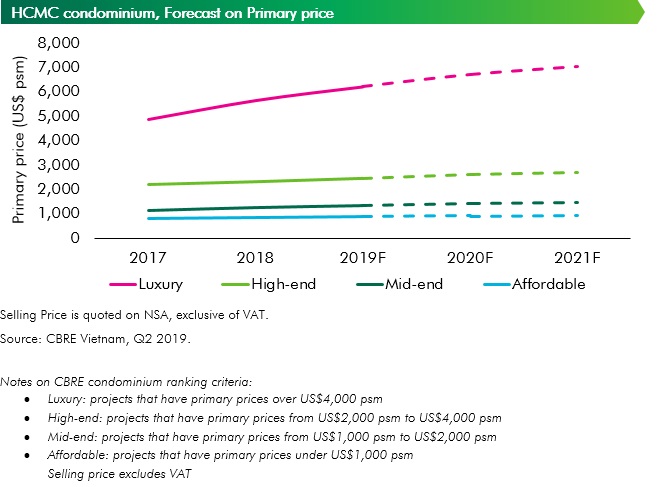

In the last three years, primary had increased by 7% y-o-y in average. In 2020 and 2021, primary selling prices are expected to have average growth rate at 5%-10% y-o-y. Mid-end segment is expected to have lower pricing escalation due to large supply coming from the East, West and South areas. Luxury segment will have prices increased by 10% y-o-y thanks to limited supply and better project quality. High-end project in the next two year will have better quality however, the location will be further to the CBD which lead to a lower growth rate of 6% y-o-y. Affordable segment will have a modest growth of 3% y-o-y.