(Photo: Viet Tuan)

Vietnam’s leading retail chain Saigon Co.op announced on June 28 it has officially taken over 15 Auchan supermarkets in the country after the French retail group announced its withdrawal from the market last month by selling its loss-making business. Auchan closed the doors of the 15 supermarkets in Hanoi, Ho Chi Minh City, and southern Tay Ninh province, while keeping its three remaining outlets in Ho Chi Minh City open. It hasn’t been that long since Auchan Retail announced it took over a hypermarket in Ho Chi Minh City from Hong Kong retailer Dairy Farm. With Vietnam’s retail market having been described as promising, with 97 million consumers, the question is why many major multinational retailers have struggled to be successful in the country.

Successive departures

Establishing a presence in Vietnam in 2015, Auchan developed a total of 21 outlets in the country. After the closure of three, Auchan Retail Vietnam continued to run 18 in three of the country’s major cities. In its 2018 financial report, Vietnam was mentioned as one of two markets that could not turn a profit. France’s leading retail chain said it could identify a suitable business model for the market and has been incurring losses as a result.

The local retailer will take over all operations of Auchan in Vietnam, including the 15 supermarkets and its online business. Saigon Co.op will manage the Auchan brand from now until the end of February 2020, before beginning new negotiations. Given this withdrawal and others, it’s clear that other European retail groups are unlikely to attempt to conquer Vietnam’s retail market anytime soon.

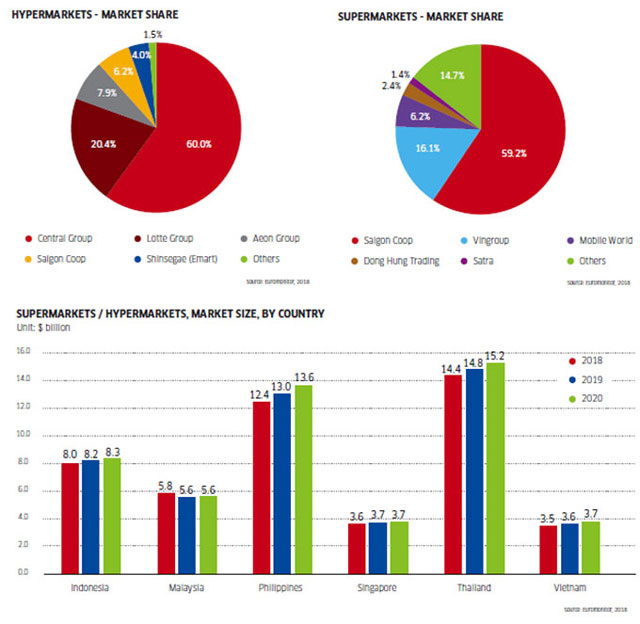

Prior to its withdrawal from Vietnam, another French retailer, the Casino Group, sold Big C Vietnam to Thai conglomerate the Central Group. Thailand’s TCC Group also purchased all of the German Metro Group’s wholesale facilities, including all commercial centers and real estate. The group bade farewell to Vietnam after years of unprofitable business, and the Metro brand disappeared from the domestic market.

Meanwhile, Malaysian retailer Parkson announced the closure of one of the last Parkson stores in Vietnam last October. Among the first retail developers in the country, arriving in 2005, Parkson initially saw great potential and drew up ambitious expansion plans. But it then gradually lost the race for market share. The Malaysian retailer commented that Vietnam’s retail market remains challenging as more and more shopping malls appear.

Moreover, the recent departures of the 24-hour convenience store chain Shop & Go and e-commerce site Robins.vn and now Auchan mirror the harsh competition in Vietnam’s retail market. Players that are financially weak or unclear about consumers’ fast-changing shopping habits will be forced out eventually.

No rose without thorns

Vietnam’s retail market is, however, still considered to have substantial potential. The shutdown or withdrawal of some foreign retailers has therefore been ascribed to inappropriate business models, limited financial capacity, or hesitation in accelerating investment as the competition becomes increasingly intense.

Meanwhile, major multinational retailers such as Japan’s Aeon Mall, South Korea’s Lotte Mart and Emart, Thailand’s Central Group, and many other convenience store chains have been unceasingly expanding their networks around the country. “Vietnam is still fertile ground for retailers, due to its rapidly-rising population and low retail density,” said Ms. Tran Mai Huong, Head of Innovation & Brand Communications at Lotte Mart Vietnam.

She emphasized that the penetration of foreign retailers has had a significant impact on the local retail market. Traditional trade channels accounted for over 70 per cent last year but saw dwindling growth of only 1 per cent, while modern retail channels occupied 26 per cent and are seeing double-digit average annual growth of 11.8 per cent. E-commerce is impressively winning over Vietnamese consumers and recording growth of 24 per cent. “Modern retail will continue to be the development trend in Vietnam’s retail market in the years to come, due to the transition of local consumers’ shopping habits towards safe food, product diversity, and shopping convenience,” she told VET.

In fact, the country’s retail sales last year reached a milestone of $150 billion and were up 12.4 per cent against 2017. In the first four months of this year, retail revenue was estimated at more than $5.15 billion, a 13.2 per cent increase over the same period of 2018 and a new record, according to the General Statistics Office.

Vietnam continues to be an exciting retail market full of opportunities but also challenges for both local and foreign players, according to Ms. Nguyen Huong Quynh, Managing Director at market researchers Nielsen Vietnam. In the context of changes in the consumer landscape (greater optimism, urbanization, different generational needs, and lifestyle) leading to emerging trends, including the rise of convenience, a preference for premium products, and health and wellness, more and more consumers are seeking shopping options that fall between fully-fledged supermarkets and shopping malls and small-format modern stores.

Trips to stock up on everything are being replaced by more frequent, needs-based shopping trips. Large format stores need to capitalize on their substantial floor space by adding more personalized services and offering deeper engagement and smart technologies to speed up and improve the shopping experience. In that context, Ms. Quynh added, Vietnamese consumers are benefiting from an open and evolving retail landscape. Opportunities will come to retailers who persistently invest in and understand continuously changing consumer needs in real time and ensure in-store execution excellence to improve the customer experience during the 4.0 era.

New retail strategies

Many industry insiders believe Vietnamese consumers now tend to prefer the “one-stop shopping” model than visiting department stores, as previously. According to Ms. Huong from Lotte Mart, the department store model created a buzz over the last two decades and became a new shopping trend among Vietnamese consumers and the central strategy of foreign retailers when entering the country.

However, due to limitations in space, she explained, retailers seem to have been unable to efficiently exploit the department store model, so a new concept has appeared - the shopping mall - which is known for its “one-stop shopping” and also entertainment. “This concept is not only the choice of shopaholics but also satisfies the entertainment needs of different age groups,” she said.

Vietnam simply can’t afford to ignore new shopping trends. “Industry 4.0 presents a raft of opportunities for the development of Vietnam’s retail market,” Ms. Huong said. “Local people are gradually becoming familiar with new online shopping models, which have encouraged domestic retailers to adapt to the rapidly-changing shopping habits of Vietnamese consumers.”

VinCommerce, the retail arm of Vietnamese conglomerate Vingroup, launched Vietnam’s first virtual store chain in May, allowing users to buy products by scanning QR codes with a smartphone app. Along with the VinMart 4.0 virtual store, customers can also experience “buying from afar” through the Smart Shopping Handbook. The VinMart 4.0 virtual store and Smart Shopping Handbook are the first such models in Vietnam, enabling customers to buy goods remotely without having to go to the supermarket. The company plans to set up 20 virtual stores in Hanoi and Ho Chi Minh City initially.

New and emerging technologies will definitely play a vital and growing role in enhancing consumption and the shopping experience, enabling more convenient consumption choices to free up time at home or opt for on-the-go and out-of-home alternatives, according to Ms. Quynh from Nielsen. “We have been seeing and continue to see more and more retailers invest in that direction, and Vietnamese consumers in general are open to new things,” she said.

She also recommended retailers remember that they are serving a large population of great diversity and there is no clear-cut consumer preference for traditional or modern channels, real touch and feel or the virtual experience. Many Vietnamese consumers prefer to touch and see items and use their own judgment when shopping for fresh food. Many consumers, especially in major cities, are heading to modern trade stores as an entertainment option, to explore new products and enjoy the wide product range. Retailers need to define a balance in their go-to-market strategy to satisfy consumers with a personalized approach.

According to Nielsen Vietnam, there remains a great deal of potential for Vietnam’s retail market to expand. Retailers, however, must take action faster to enhance the customer experience, and large format stores need to capitalize on their substantial floor space by adding more personalized services.