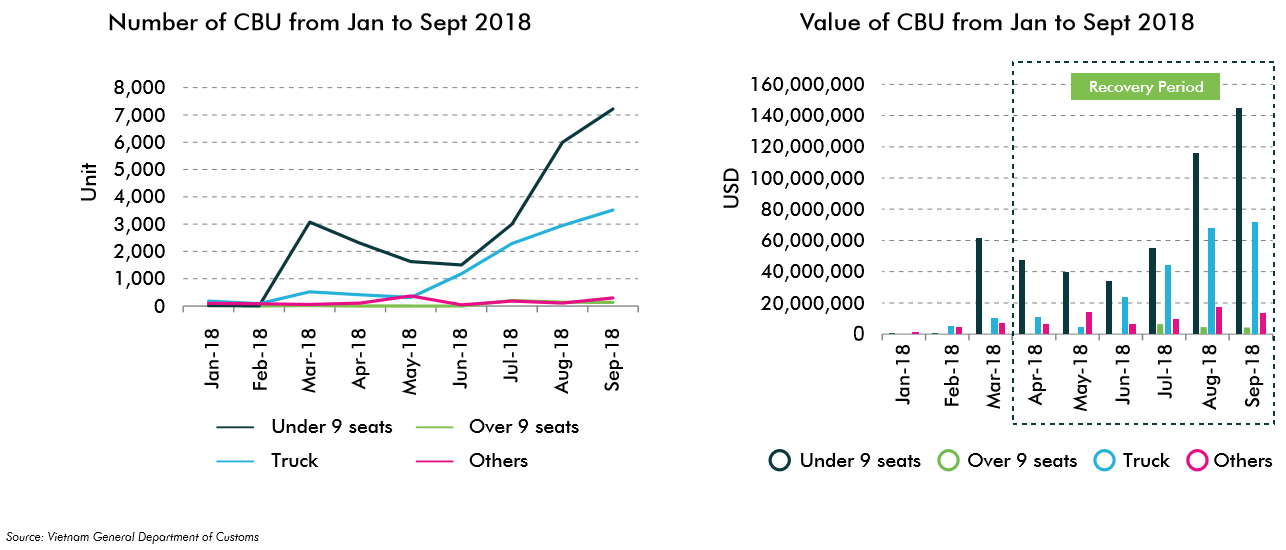

Government legal adjustments have immediately imposed its impact on the market. From January to February 2018, the number of imported car decreased dramatically. Only 66 car were imported in the first two month of 2018, the lowest number ever recorded.

However, the market reacted rapidly to policy changes. Since March 2018, the figure revealed a significant rise in terms of unit volume and value. The import reached 11,172 units in September 2018, which is equivalent to a total of US$234,150,343 in value.

Furthermore, it is worth noticing that Thailand and Indonesia dominate the CBU market. They benefit from the ASEAN Trade in Goods Agreement (ATIGA) which reduces import tax rate of ASEAN origin CBU to 0% (effective on 01 January 2018). In addition, these countries are automobile manufacturing centers of the region and easily support automakers to meet new criteria for CBU of Vietnamese government.

It could be observed that ASEAN-based-factory automakers have dealt with the sudden changes in the market quite well. Companies such as Toyota and Honda could easily obtain VTA from authority of automobile-export-oriented countries.

Meanwhile, the tightened regulations, along with Circular No.03/2018/TT-BGTVT have set more challenges for European automobile companies. However, it is just the matter of time. The aim of domestic protection seems to be a failure in term of decreasing CBU volume. Nevertheless, there is still a chance for domestic manufacturing industry and even for industrial real estate.

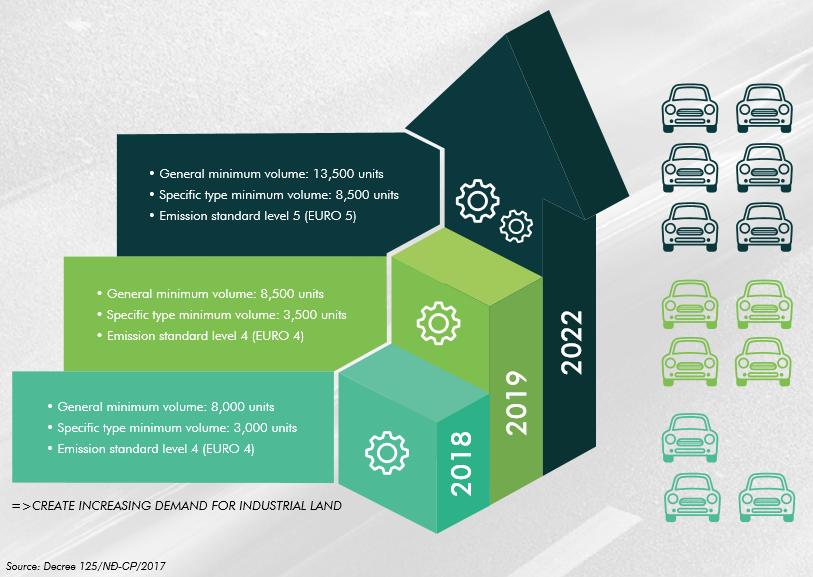

According to the Decree 125, qualified automobile corporation for the tax incentives scheme must commit a minimum CKD volume in general and for specific types of car as well as technical standards in the period from 2018 to 2022. Consequently, CKD assemblers and car producers do not only comply with the Decree 116 but also must increase their production volume, improve technical quality and furthermore level up localization rate of CKD to meet the legal requirements of Decree 125.

Effective time length of the Decree 125 is considered quite short and fairly rush for local assemblers and manufacturers to exploit its benefit. Based on the regulations and manufacturing capability of assemblers, only three automobile corporations can fulfil the producing conditions in the meantime. They are THACO Group, Toyota Vietnam and Hyundai Thanh Cong which are major players in the market. In term of sale unit (including all type of car), THACO accounts for average 38% of Vietnam automobile market while Toyota Vietnam stands in the second with approximate 25% of market share.

Foreign automakers such as Toyota and Honda have been expected to withdraw from or at least reduce production scale in Vietnam. Alternatively, they are going to switch their business strategy to CBU trading rather than automobile assembling. They invested significantly into factories in Thailand and Indonesia to make use of ATIGA’s regulations. Furthermore, assembling cost of an automobile unit in Vietnam is higher than that of Thai or Indonesian factories due to a very low localization rate.

The Decree 116 almost shuts the door for CBU into Vietnam in the first three months of 2018. Likewise, Decree 125 is considered as a leverage for the domestic industry by using tax incentive methods. In general, neither changes in policy nor in business strategy can prevent the ambitious automakers from trying their best to dominate a very fast-growing automobile market.

Because of the new regulation, demand for factory expansion as well as logistic infrastructure development is increasing rapidly. The application of the new decrees has pushed manufacturers into a race of increasing production scale. Furthermore, Vietnam automobile market is still highly potential regarding market scale and consumer demand. As a result, manufacturing expansion is inevitable. It is not only about compliance issue but also about strategically investment plan.

THACO recently launched two of its large factories located in Chu Lai - Truong Hai Complex (Quang Nam province). The first one is Mazda-car-manufacturing factory (Phase 1) that delivers to the market 50,000 units/year. It is the most modern Mazda-car-manufacturing factory in South East Asia and acquires a land area of 300,000 sqm. The second launched factory is Bus THACO with designed capacity of 20,000 units per year. The addition of new factories has strengthened THACO’s dominance of the market.

Toyota Vietnam also deployed expansion plan of its current automobile factory in Vinh Phuc province. Under the plan, a land area of 91,000 sqm located next to Toyota’s Vietnam current site will be leased for developing their new factory. The new production line is designed to increase Toyota’s manufacture capacity to 90,000 units per year in 2023. The factory upgrade is a surprised action from Toyota Vietnam as they were expected to narrow production scale and switch to focus on CBU trading.

Mitsubishi cannot stand out of the race by declaring that they are looking for a suitable location for building their second factory in Vietnam with designed capacity up to 50,000 units/year.

Vinfast's new production complex in Hai Phong.

The most notable factory opening obviously belongs to VinFast (the newborn automobile arm of Vingroup). Vingroup, a Vietnamese real estate and retail conglomerate, has shown its huge ambition in producing the very first Vietnam branded car.

Accordingly, they deployed construction of their mega automobile complex in Dinh Vu - Cat Hai Industrial Zone (Hai Phong City) since September 2017. The complex has been built in a land area of 3,350,000 sqm. Designed capacity of factory is 250,000 units per year in Phase 1 and will be leveled up to 500,000 units per year in Phase 2.