Ho Chi Minh City average selling price gained 4-20% y-o-y due to limited new launch

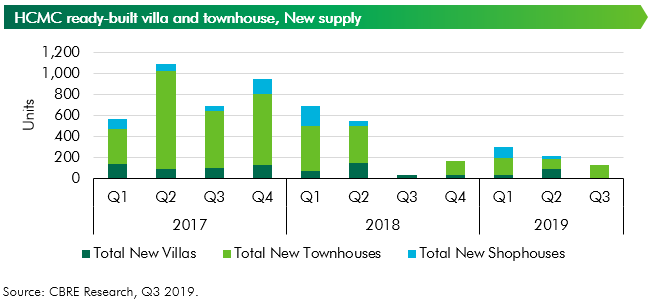

The shortage of new supply was recorded again in the third quarter of 2019 in the ready-built villa and townhouse segment despite high expectation for the launch of large-scale projects, according to a recent report by market research firm CBRE. Specifically, the whole market had 127 new townhouses launched from three projects located in Go Vap District (66 units), Tan Phu District (21 units) and District 12 (40 units). Growth of cumulative supply across the city was only 0.8 percent over the last quarter, the lowest level in the last four consecutive quarters and the new supply decreased by 41 percent over the same quarter. The primary asking price of newly launched units ranges from US$2,300 per square meter of land and US$5,200 per square meter of land (District 12 and Tan Phu District) to about US$10,000 per square meter of land (Go Vap District). The projects launched in this quarter did not achieve high sold rate (only from 13 percent to 52 percent) although there were not many new supplies in the market. The reason may come from the reluctance to trade in the lunar-calendar July, while the new projects were developed on small scale by less reputable developers as well as the availability of more attractive investment options in neighboring provinces of HCMC such as Dong Nai and Long An.

The market was expected to welcome large supply from both well-known Vietnamese and foreign developers at the end of the quarter. However, due to many unexpected reasons, these projects have been delayed until the end of 2019. This continues to make HCMC’s market less attractive when the new supply "dripped" and the asking price was levelled up significantly due to regular change of owner on the secondary market. In contrast, the market in the neighboring provinces of HCMC, such as Dong Nai and Long An, in the past quarter has received much more interest with the introduction of large township projects. For example, in the bordering districts of Dong Nai province and HCMC, the new supply launched in the first nine months was about 24 percent higher than that of the whole HCMC. Ready-built villa and townhouse projects in the provinces focus on clean living environment and green landscape along with attractive prices and payment policies. Township projects that are expected to enjoy a boost in connecting to HCMC are attracting a lot of attention from buyers.

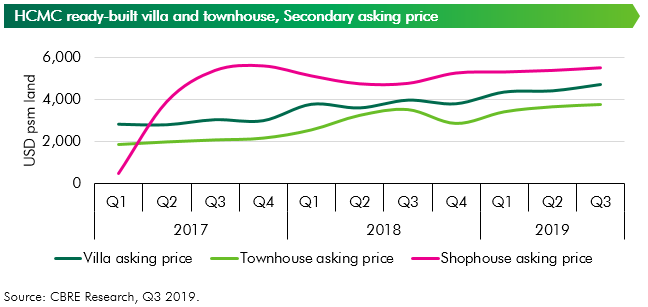

Regarding price movements from the beginning of the year until now, the secondary asking price has maintained a slight upward trend. Secondary asking price of ready-built townhouses has increased 3 percent from the previous quarter and 4.2 percent from the previous year on the transfer market. For shophouses, the secondary asking price increased by 2.3 percent compared to last quarter and 4.5 percent compared to the same period last year. Particularly, secondary asking price of ready-built villa achieved the best growth when it recorded 6.8 percent increase from the previous quarter and 20.1 percent annual growth rate.

It is expected that new supply will prosper in the last three months of the year with about 500-600 units launched to attract buyers at the end of the year time. Cumulative supply growth in the year-end is expected to reach 3.1 percent quarterly and 7.4 percent annually with the total new supply in 2019 expected to be approximately 1,150 units. The eastern and southern areas will continue to lead the market with notable projects such as Verosa Park (Khang Dien), Vinhomes Grand Park (Vingroup), ZeitGeist Nha Be (GS E&C), Senturia An Phu (Tien Phuoc), Golf View Residence (Novaland). The upward trend of asking price is still upheld with an increase of 2-4 percent quarter over quarter and 10-20 percent yearly.

Hanoi market supply to expand further from established residential clusters

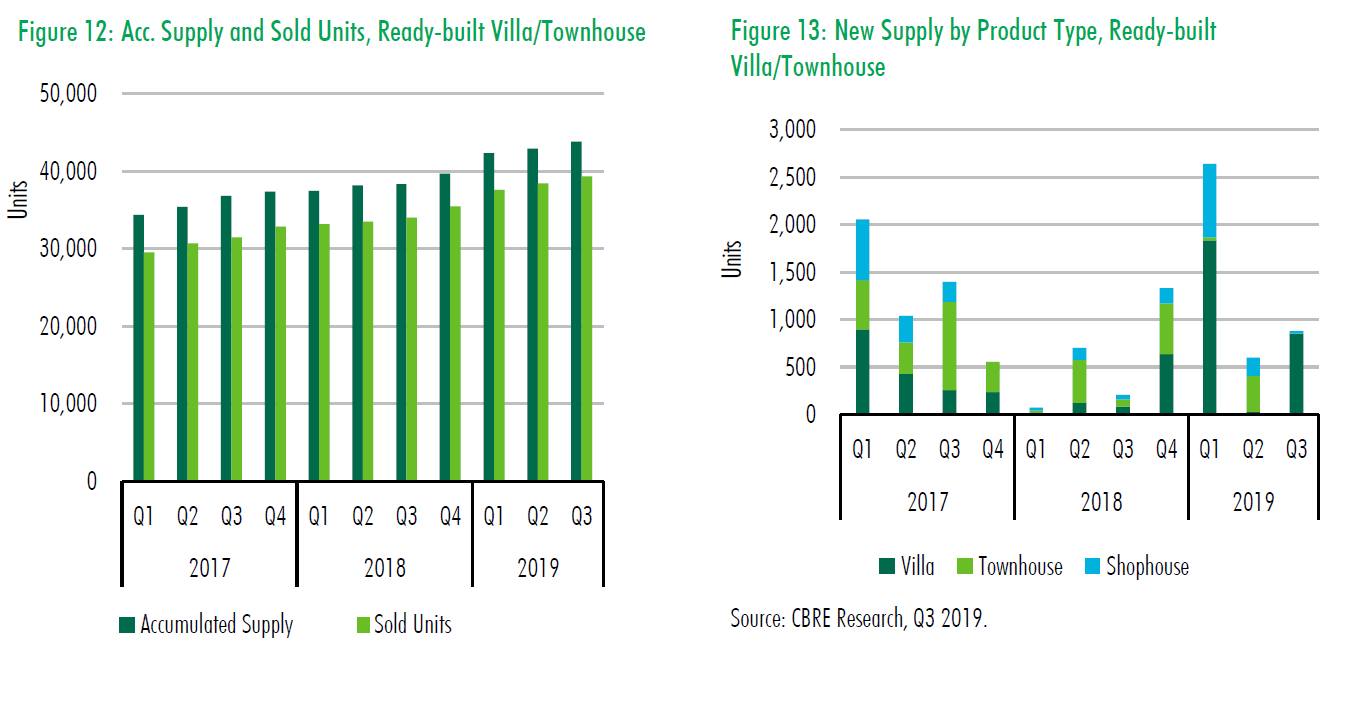

The third quarter of 2019 recorded 879 newly launched units, adding to the total new supply of 4,120 units during the first nine months of 2019. Sales performance continued to reveal positive market sentiments for landed properties in Hanoi, with 873 sold units, up by 3 percent compared to the last quarter and 67 percent compared to last year. Total sold units at the nine-month benchmark of 2019 arrived at 3,853 units, 1.5 times higher comparing to 2018, all quarters combined.

The market continued to observe greater shift of new supply in terms of location, with increasing proportion made up of projects in Hoai Duc, Ha Dong, and Dan Phuong. In the first nine months of 2019, the three districts provided almost 25 percent of the total new supply. While overall market supply remains predominantly captured by the West, the pipeline is moving further to emerging locations in North West and South West, instead of established residential clusters such as Nam Tu Liem and Cau Giay. Improving infrastructure with future planning for road expansion and construction remained the significant drivers for both supply and price levels in these new locations.

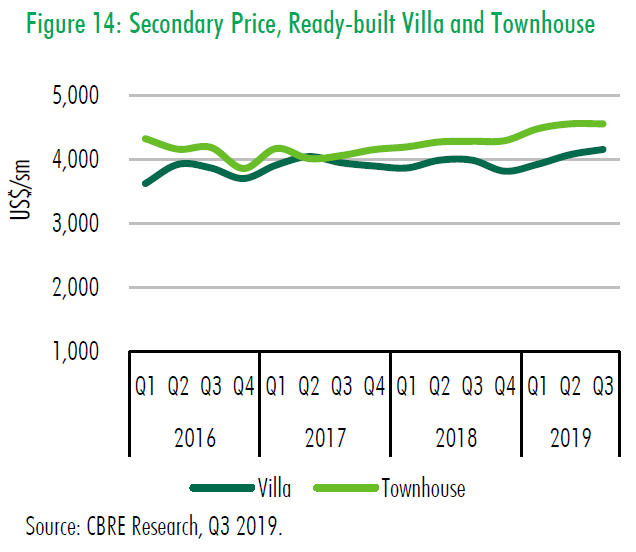

In terms of market performance, the secondary price for villas in the third quarter of 2019 averaged US$4,157 per square meter, with VAT and construction costs all included. This posted a growth rate of 2.0 percent from the previous quarter and 4.2 percent from the previous year. Price was seen to improve across locations, especially at emerging residential clusters in Gia Lam, Hoai Duc and Ha Dong.

Hanoi is set to welcome a great volume of new supply from large-scale township developments. Supply will expand even further to the North and South of Hanoi, with notable projects down the pipeline such as BRG & Sumitomo Smart City in Dong And and Gamuda Lakes in Hoang Mai.